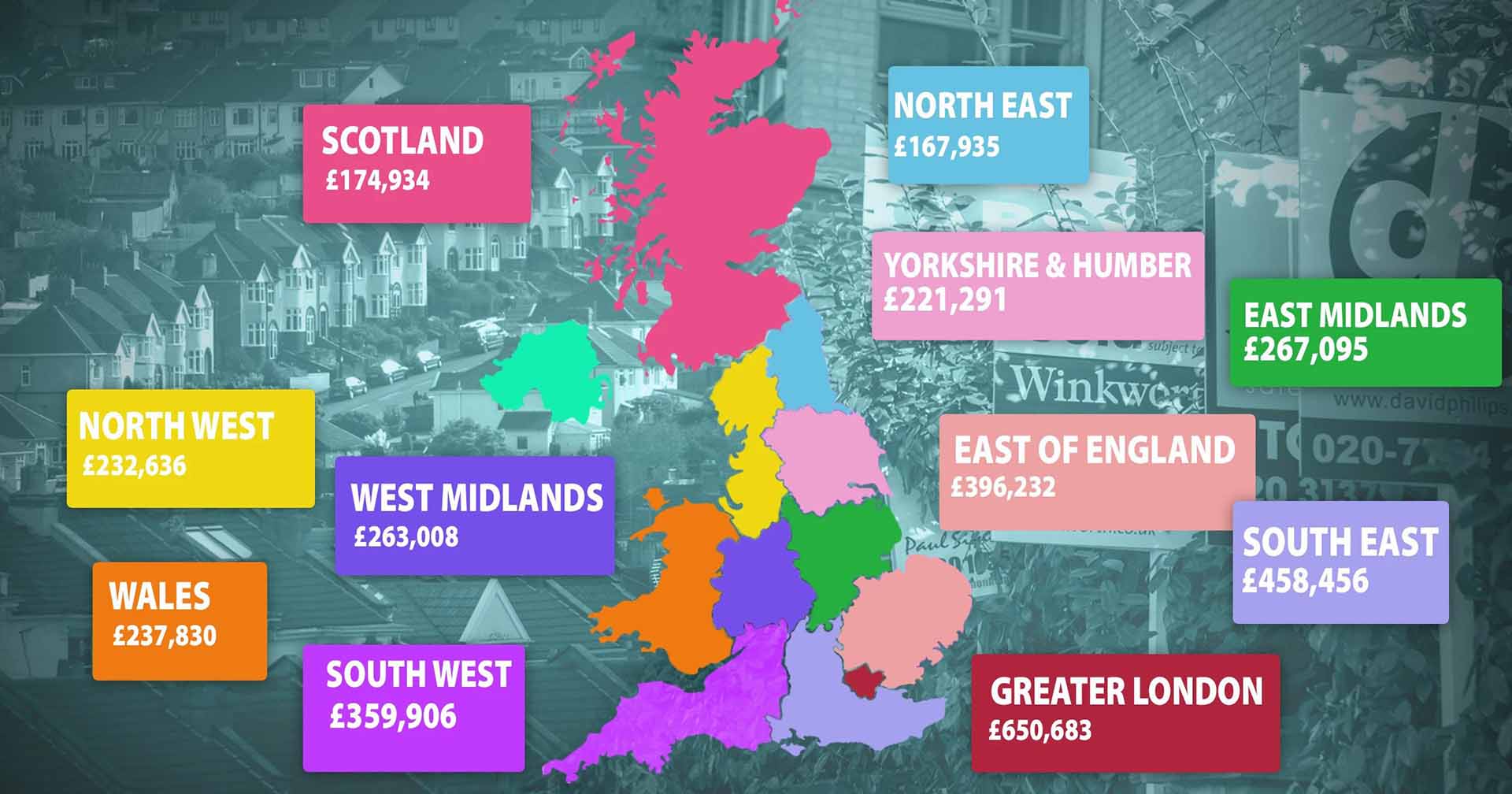

Home specifies that the supply rate of new sales listings remains remarkably low across all English regions, Scotland and Wales, despite the fact that properties outside of Greater London are achieving record valuations.

While still below their May 2016 peak, London prices are beginning to rise and look to be entering a new period of growth, supported by a rapidly recovering rental market especially in the more central boroughs. Home says that after an 18-month battering by the pandemic, confidence is returning to the capital’s property market.

The sales stock total in London has been steadily eroded by 16 per cent since the oversupply peak in late 2020; it suggests demand looks set to increase on the back of rapidly rising rents as investors, both private and institutional, spot yield and capital gains opportunities.

Outside London, shrinking sales and rental inventories continue to push up both prices and rents.

Even so, the number of new instructions entering the sales market across the UK continues to be very low compared to pre-Covid levels (down 24% July 2021 vs. July 2019). The number of newly available rental properties entering the market is also down considerably across the UK (down 27 per cent between July 2020 and July 2021).

Sales supply looks set to remain low until mortgage payment deferral schemes end, says Home – no date has been set for these, but they may coincide with the end of the current furlough scheme at the end of September.

The East of England and Wales now lead in terms of regional price growth, with annualised home price inflation of 11.2 and 10.7 per cent respectively, supported by high demand and low supply.