Trellows Property Market Update March 2023

An overview of the UK residential property market

Summary

This month saw the 11th interest rise in 15 months, taking the base rate from 0.1% in December 2021, to 4.25% a rise of 4,250%. The current rate may not be high by historical standards and still remains lower than the median average, but following 15 years of historical lows, that have resulted in much higher borrowing overall, the effects of the increase have had an enormous effect on borrowers, as the larger average mortgage has amplified the effects of the increase, but how does this affect the market overall?

Background

This month, the UK base rate has risen to its highest level since 2008. There are many contributing factors to the need for the base rate to rise, although it was inevitable that the base rate has been at a historical low since the last financial crisis and therefore, it was only a matter of time.

In real terms, the current rate of 4.25% is having a greater impact on borrowers that it would have done in the past, due to the higher earning to borrowing ratio, as the value of mortgages has risen exponentially.

With inflation for 2022 ending at over 10% (although it much higher in real terms) and although it was predicted to fall this year, the latest figures for March, confirmed that contrary to falling, inflation had risen to 10.4% which signalled the latest rate rise.

The true impact of higher borrowing costs along with the general slow-down of the property market has not made its way to the public forum yet, as there is long time lag between agreed sales and published figures.

The sales that are completing now, are still for the main part, sales that were agreed before the disastrous mini-budget, that rocked the money markets, it then takes upwards of three months from the point of completion before figures are published on the land registry website.

The figures that we do have, indicate that on average, property is already at or below the figure it was at he beginning of 2022, with further falls on the horizon.

However, if we then factor in an anticipated compound inflation rate for 2022-2023 by the end of this year, that is on course to be in excess of 20%, then we can see that in real terms, property need only fall by 10% which is being accepted to be a minimum, by most of the industry pundits, whether they admit it openly or not, for house prices to end the year 30% lower than they were at the start of 2022.

In addition to this, there has already been a fall in wages(adjusted for inflation) of around 5% minimum, with the possibility of a further 5% fall by the end of this year, which has seriously effected affordability.

The inevitable fall in prices, is not by any means anything to be alarmed about, the combination of affordability, due to inflation and lower wages (when adjusted for inflation) in addition to all the other factors within the UK economy, but should we be alarmed by this and expect a property meltdown?

The short answer is no, there is always a correction in property prices at some point in the cycle and this is simply that time now. The impact of exiting lockdown, rocketing energy costs and an over-heated market, thanks to the stamp duty holiday have contributed to the ‘perfect storm’ which should not come as any surprise to any of us.

London property market snapshot

Interest Rates 2020-2023

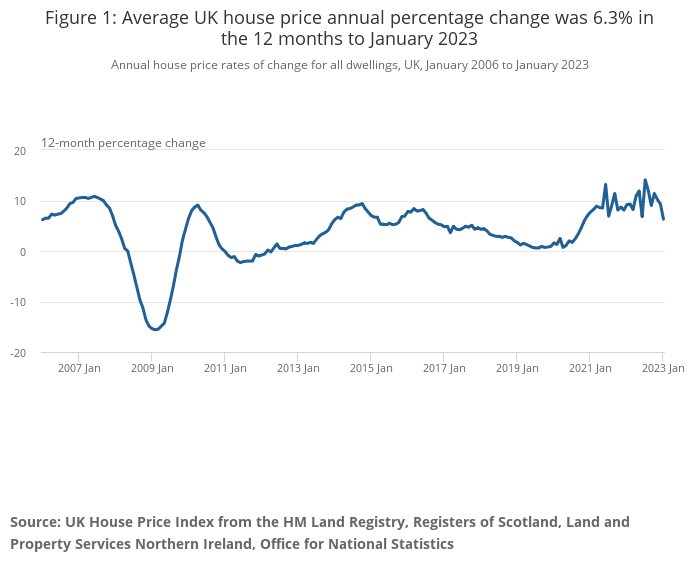

Average house price change since 2007

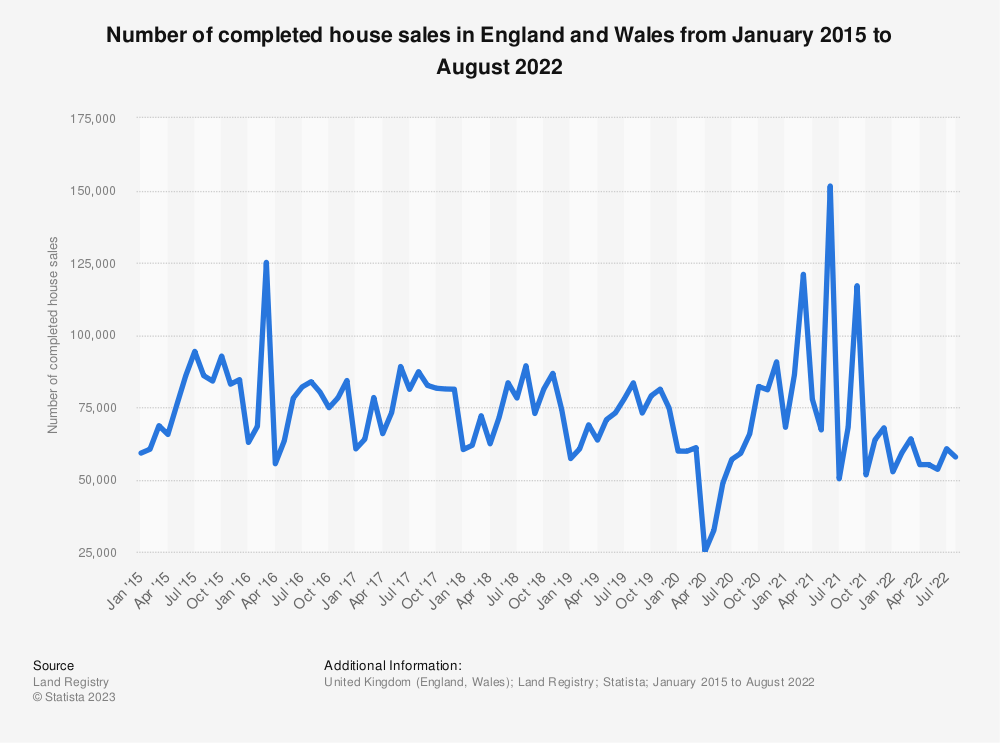

Completed house sales 2015-2022

The average house price change since January 2023 is even steeper than the fall in 2008.

As we can see, July 2022, was clearly the peak of the current cycle, with completions falling to their lowest level since 2008 (with the exception of the lockdown)

Additional contributing factors

The Renter’s Reform Bill’ is expected to get through parliament in the next few months, which will transform the rental market significantly. This on top of the Section 24 income tax act, has contributed to an exodus of buy-to-let landlords from the market. Although there is an increasing entry in the buy-to-let market by the corporations, (15% of property sales in 2022, were to institutional investors) with Lloyds Bank declaring that it intends to be the UKs largest landlord by 2025 and even Tesco making an entry in the ‘Build-to-Rent’ market, these institutional investors are not likely to be taking up the properties off-loaded by exiting buy-to-let landlords.

On top of this, there is the anticipated raising of the minimum EPC rating for rental properties, from the current ‘E’ to a ‘C’ in 2025, although this has yet to be confirmed. This has certainly added fuel to the fire, with over 60% of rental properties in the UK being rated ‘D’ or lower, the cost to landlords could be prohibitive.

In addition to this, yet more bad news for landlords, has been the recent increase in the ‘stress-test’ by most buy-to-let lenders. When this was introduced, it was set at 125% of the rental income, that is to say, that the rent needed to be at least 125% of the prevailing interest payments. However, many lenders have increased the rate to as much as 141% in recent months, which added to significantly higher rates, many landlords are failing the stress tests and therefore unable to re-fix with a better deal, leaving them exposed to BTL variable rates, which are as high as 9%.

All this factors combined have spelt disaster for the thousands of individual BTL landlords.

Conclusion

Whilst the current situation may seem to be the recipe for Armageddon in the property market, there are also many reasons why the market will not grind to a halt.

First Time buyers:

There is without doubt a growing number of first time buyers, who should be very careful about buying at this time with a small deposit of course, as they risk finding themselves in negative equity for the next few years, but as the slide in prices begins to ease, there will be a tipping point, where those who can, will begin to enter the market..

Next Time Buyers:

Regardless of the situation in the property market, this need not be an obstacle to those who need to move and for those moving upwards, there could even be a benefit. The key here is to ensure that you are using a good estate agent, who is not only going to be realistic about the property market, but one who will also work hard to ensure that your property is noticed amongst the increasingly growing number of properties coming to market.

Albeit in lower numbers, properties are still selling, but it is only those that are priced realistically that are finding buyers. The key for next-time-buyers is that although they may need to take an offer lower than they had hoped for, that drop can/should also be reflected (in percentage terms) on the property that they are buying.

If you want or need to sell, in the current climate, the worst thing that sellers could do, is to go on the market too high, the longer that their property is on the market, the lower the final selling price will be.

Investors

There is a large number of investors, already looking for a bargain, but far more who are waiting for the fall to level off, before they begin to enter the market, therefore many of the properties that are either on the market, or due to come to market this year, will find buyers, albeit at a lower price, which will cushion the fall.

Demographics

The ownership of property has changed significantly over the last two or three decades, with an increase in numbers who are either renting, or mortgage free. Those who need to rent, will continue to do so, regardless of the rising rents, even if many do decide to resume living at home, the demand for rental properties continues to out-strip supply.

These two factors combined, result in the effects of higher interest rates impacting a smaller percentage of households in the UK, therefore the likely hood of the housing crisis of the early 90s, where thousands of homeowners were handing back their keys, very unlikely.