A Fairer Private Rented Sector

Foreword from the Secretary of State

In the words of Michael Gove

Everyone has a right to a decent home. No one should be condemned to live in properties that are inadequately heated, unsafe, or unhealthy. Yet more than 2.8 million of our fellow citizens

are paying to live in homes that are not fit for the 21st century. Tackling this is critical to our mission to level up the country. The reality today is that far too many renters are living in damp, dangerous, cold homes, powerless to put things right, and with the threat of sudden eviction hanging over them. They’re often frightened to raise a complaint. If they do, there is no guarantee that they won’t be penalised for it, that their rent won’t shoot up as a result, or that they won’t be hit with a Section 21 notice asking them to leave. This Government is determined to tackle these injustices by offering a New Deal to those living in the Private Rented Sector; one with quality, affordability, and fairness at its heart. In our Levelling Up White Paper – published earlier this year – we set out a clear mission to halve the number of poor-quality homes by 2030. We committed to levelling up quality across the board in the Private Rented Sector and especially in those parts of the country with the highest proportion of poor, sub-standard housing – Yorkshire and the Humber, the West Midlands, and the North West. This White Paper – A Fairer Private Rented Sector – sets out how we intend to deliver on this mission, raising the bar on quality and making this New Deal a reality for renters everywhere. It underlines our commitment, through the Renters

The Bill also fulfils our manifesto commitment to replace Section 21 ‘no fault’ eviction notices with a modern tenancy system that gives renters peace of mind so they can confidently settle

down and make their house a home. These changes will be backed by a powerful new Ombudsman so that disputes between tenants and landlords can be settled quickly and cheaply, without going to court. This white paper also outlines a host of additional reforms to empower tenants so they can make informed choices, raise concerns and challenge unfair rent hikes without fear

of repercussion. Of course, we also want to support the vast majority of responsible landlords who provide quality homes to their tenants. That is one of the reasons why this White Paper sets out our commitment to strengthen the grounds for possession where there is good reason for the landlord to take the property back. Together, these reforms will help to ease the financial burden on renters, reducing moving costs and emergency repair bills. It will reset the tenant-landlord relationship by making sure that complaints are acted upon and resolved quickly. Most importantly, however, the reforms set out in this White Paper fulfil this Government’s pledge to level up the quality of housing in all parts of the country so that everyone can live somewhere which is decent, safe and secure – a place they’re truly proud to call home.

Executive summary

Everyone deserves a secure and decent home. Our society should prioritise this just like access to a good school or hospital. The role of the Private Rented Sector (PRS) has changed in recent decades, as the sector has doubled in size, with landlords and tenants becoming increasingly diverse. Today, the sector needs to serve renters looking for flexibility and people who need to move quickly to progress their careers, while providing stability and security for young families and older renters. It must also work for a wide range of landlords, from those with a single property through to those with large businesses. Most people want to buy their own home one day and we are firmly committed to helping Generation Rent to become Generation Buy. We must reduce financial insecurities that prevent renters progressing on the path to home ownership and, in the meantime, renters should have a positive housing experience.

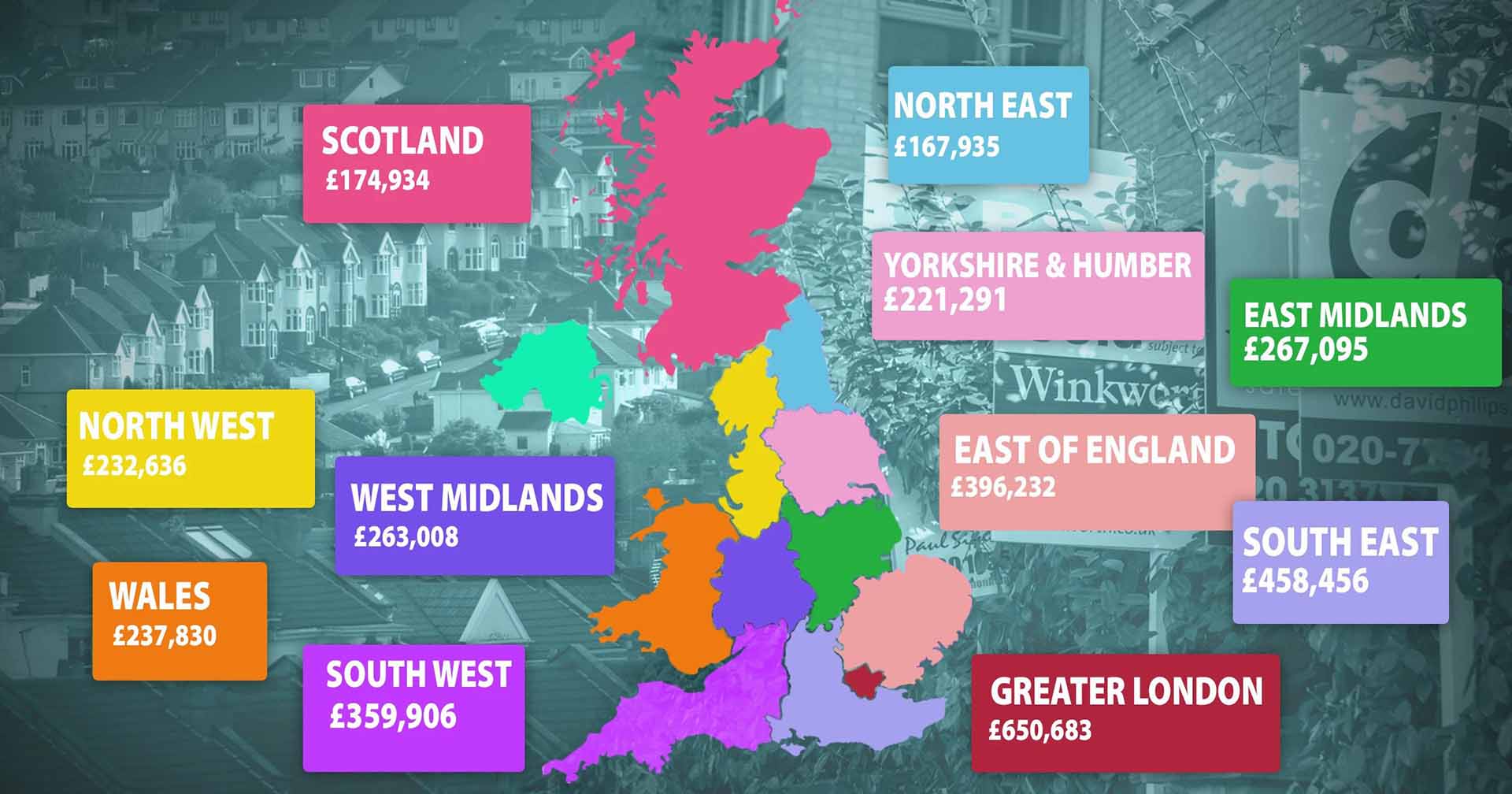

This White Paper builds on the vision of the Levelling Up White Paper and sets out our plans to fundamentally reform the Private Rented Sector and level up housing quality. Most private landlords take their responsibilities seriously, provide housing of a reasonable standard, and treat their tenants fairly. However, it is wrong that, in the 21st century, a fifth of private tenants in England are spending a third of their income on housing that is non-decent. Category 1 hazards – those that present the highest risk of serious harm or death – exist in 12% of properties, posing an immediate risk to tenants’ health and safety. This means some 1.6 million people are living in dangerously low-quality homes, in a state of disrepair, with cold, damp, and mould, and without functioning bathrooms and kitchens. Yet private landlords who rent out non-decent properties will receive an estimated £3 billion from the state in housing related welfare. It is time that this ended for good. No one should pay to live in a non-decent home. Poor-quality housing is holding people back and preventing neighbourhoods from thriving. Damp, and cold homes can make people ill, and cause respiratory conditions. Children in cold homes are twice as likely to suffer from respiratory problems such as asthma and bronchitis. Homes that overheat in hot summers similarly affect people’s health. In the PRS alone, this costs the NHS around £340 million a year. Illness, caused or exacerbated by living in a non-decent home, makes it harder for children to engage and achieve well in school, and adults are less productive at work. There is geographical disparity with the highest rates of non-decent homes in Yorkshire and the Humber, the West Midlands and the North West. Visibly dilapidated houses undermine pride in place and create the conditions for crime, drug use, and antisocial behaviour. Too many tenants face a lack of security that hits aspiration and makes life harder for families. Paying rent is likely to be a tenant’s biggest monthly expense and private renters are frequently at the sharpest end of wider affordability pressures. Private renters spend an average of 31% of their household income on rent, more than social renters (27%) or homeowners with mortgages (18%),8 reducing the flexibility in their budgets to respond to other rising costs, such as energy.

Frequent home moves are expensive with moving costs of hundreds of pounds.9 This makes it harder for renters to save a deposit to buy their own home. Over a fifth (22%) of private renters who moved in 2019 to 2020 did not end their tenancy by choice, including 8% who were asked to leave by their landlord and a further 8% who left because their fixed term ended. The prospect of being evicted without reason at two months’ notice (so called ‘no fault’ Section 21 evictions) can leave tenants feeling anxious and reluctant to challenge poor practice. Families worry about moves that do not align to school terms, and tenants feel they cannot put down roots in their communities or hold down stable employment. Children in insecure housing experience worse educational outcomes, reduced levels of teacher commitment and more disrupted friendship groups, than other children.11 In 2019 to 2020, 22% of tenants who wished to complain to their landlord did not do so. In 2018, Citizens Advice found that if a tenant complained to their local council, they were five times more likely to be evicted using Section 21 than those who stayed silent.13 The existing system does not work for responsible landlords or communities either. We must support landlords to act efficiently to tackle antisocial behaviour or deliberate and persistent non-payment of rent, which can harm communities. Many landlords are trying to do the right thing but simply cannot access the information or support that they need to navigate the legal landscape, or they are frustrated by long delays in the courts. In addition, inadequate enforcement is allowing criminal landlords to thrive, causing misery for tenants, and

damaging the businesses and reputations of law-abiding landlords. Collectively, this adds up to a Private Rented Sector that offers the most expensive, least secure, and lowest quality housing to 4.4 million households, including 1.3 million households with children and 382,000 households over 65.14 This is driving unacceptable outcomes and holding back some of the most deprived parts of the country.

Our ambition

We are committed to delivering a fairer, more secure, and higher quality Private Rented

Sector. We believe:

1. All tenants should have access to a good quality, safe and secure home.

2. All tenants should be able to treat their house as their home and be empowered to challenge poor practice.

3. All landlords should have information on how to comply with their responsibilities and be able to repossess their properties when necessary.

4. Landlords and tenants should be supported by a system that enables effective resolution of issues.

5. Local councils should have strong and effective enforcement tools to crack down on poor practice.

What we have done

We have taken significant action over the past decade to improve private renting. In 2010, 1.4 million rented homes were non-decent, accounting for 37% of the total. This figure has fallen steadily to 1 million homes today (21% of the total).15 To improve safety standards, we have required landlords to provide smoke and carbon monoxide detectors as well as regular electrical safety checks. We supported the Homes (Fitness for Human Habitation) Act 2018, which means landlords must not let out homes with serious hazards that leave the dwelling unsuitable for occupation.

To help tenants and landlords in resolving disputes, we made it a requirement in 2014 for letting and managing agents to belong to a government-approved redress scheme. We have also given local councils stronger powers to take action against landlords who do not meet expected standards. We have introduced Banning Orders to drive criminal landlords out of the market, civil penalties of up to £30,000 as an alternative to prosecution, and a database of rogue landlords and agents. Over the last five years, we have awarded £6.7 million to over 180 local councils to boost their enforcement work and support innovation.

To reduce financial barriers to private renting, we have capped most tenancy deposits at five weeks’ rent and prevented landlords and agents from charging undue or excess letting fees. Between 2010-11 and 2020-21 the proportion of household income (including housing benefit) spent on rent by private renters reduced from 35% to 31%.16 We have taken additional steps to protect private tenants when exceptional circumstances required. During the Coronavirus pandemic our emergency measures helped tenants to remain in their homes by banning bailiff evictions, extending notice periods, and providing unprecedented financial aid. These measures worked. There was a reduction of over 40% in households owed a homelessness duty following the end of an Assured Shorthold Tenancy (AST) in 2020 to 2021 compared with 2019 to 2020,17 and repossessions by county court bailiffs between January and March 2022 were down 55% compared to the same quarter in 2019.

Comment

This is a very brave and necessary course of action, to deal with the housing crisis. Housing costs have risen exponentially, since the late 1990s, when the population began to grow rapidly due to migration. The true number of migrants in the UK is not known, but one thing is for certain, there are upwards of TEN MILLION more people in the UK today, than there were just a decade ago, probably much more, they all need to live somewhere and although this may be devastating to landlords who have worked hard to purchase property to secure themselves an income for the future, especially as many have been denied their anticipated income from pension funds that have been stagnant, the government does need to look at the bigger picture and act quickly, before this crisis evolves in to civil unrest.

Download the full White Paper HERE

The new portal OpenBrix, which is powered by Blockchain, has revealed its fee structure ahead of its formal launch on September 1.

The new portal OpenBrix, which is powered by Blockchain, has revealed its fee structure ahead of its formal launch on September 1.