Trellows Property Market Update – Cambridgeshire July 2023

**House Prices in Cambridgeshire: A Look at the Market Trends**

Cambridgeshire, known for its prestigious universities, picturesque countryside, and vibrant cities, has become a desirable location for property buyers and investors. As the region continues to attract people from all walks of life, let’s take a closer look at the current house prices in Cambridgeshire and the trends that have shaped the market over the last year.

**Overall Average Price**

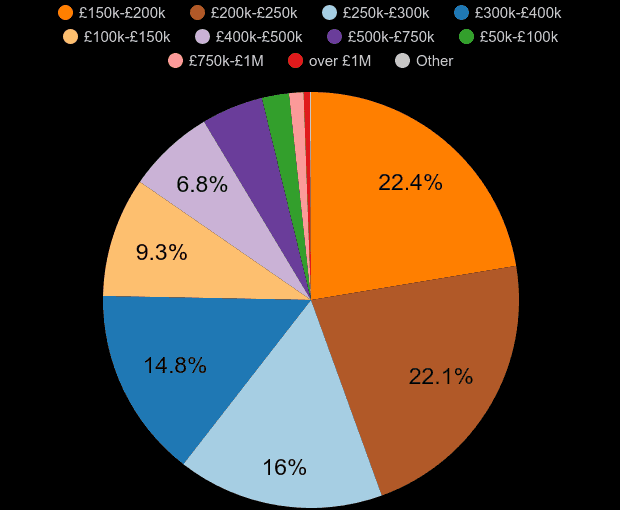

Over the past year, properties in Cambridgeshire had an overall average price of £376,949. This figure encompasses various types of properties, ranging from detached houses to flats, and provides a general understanding of the region’s property market.

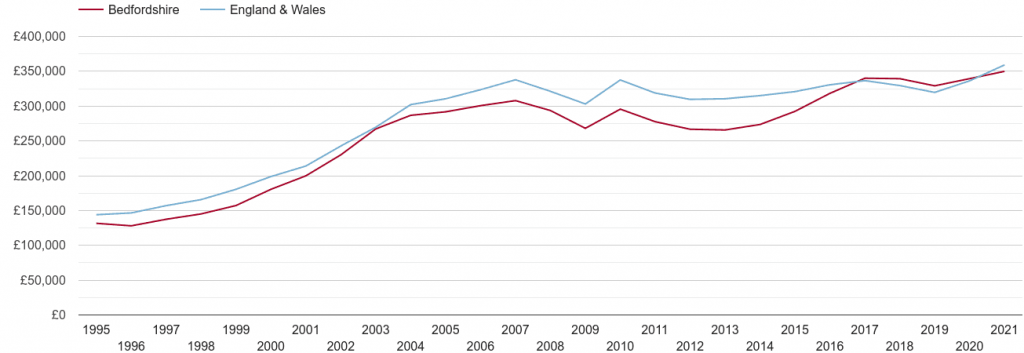

**Detached Properties**

Detached properties have dominated the market in Cambridgeshire, with the majority of sales falling under this category. The average price of a detached house in the region was £515,434 over the last year. These spacious and independent homes have proven to be popular among buyers seeking privacy and ample living space.

**Semi-Detached Properties**

Semi-detached properties, another sought-after choice for families and first-time buyers, had an average selling price of £338,312. These homes offer a good compromise between affordability and space, making them a practical option for many buyers.

**Terraced Properties**

Terraced properties, often offering a charming and compact living space, had an average selling price of £306,726 in Cambridgeshire. These homes can be a great choice for buyers seeking a sense of community and a central location.

**Market Trends**

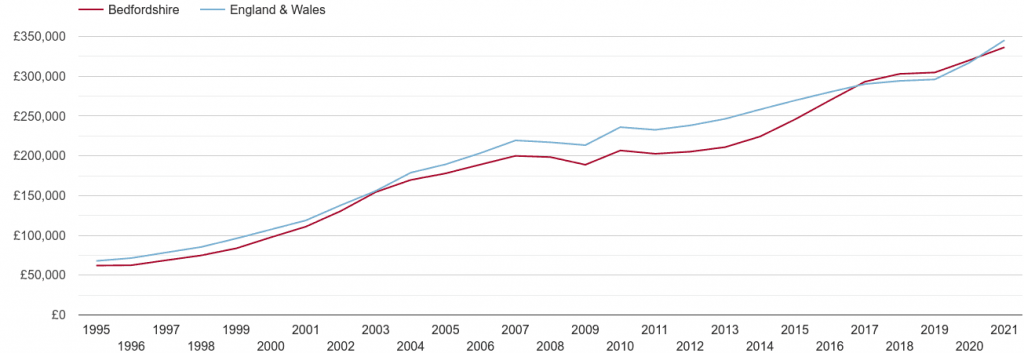

The property market in Cambridgeshire experienced significant growth over the last year. Sold prices were 7% higher compared to the previous year, showcasing a strong demand for properties in the region. Moreover, prices were up by an impressive 14% when compared to the 2020 peak of £330,837, indicating a sustained upward trend in property values.

**Noteworthy Sales**

Let’s take a look at some notable property sales in Cambridgeshire:

| Date sold | Property Address | Property Type | Sale Price (£) | Tenure |

|---|---|---|---|---|

| 23 May 2023 | 25, The Oaks, Soham, Ely, Cambridgeshire CB7 5FF | Detached | £625,000 | Freehold |

| 19 May 2023 | 93, Appletrees, Bar Hill, Cambridge, Cambridgeshire CB23 8SW | Detached | £430,000 | Freehold |

| 19 May 2023 | 17, Star Lane, Ramsey, Huntingdon, Cambridgeshire PE26 1JJ | Detached | £295,000 | Freehold |

| 19 May 2023 | 4, Vicarage Close, Oakington, Cambridge, Cambridgeshire CB24 3AN | Detached | £475,000 | Freehold |

| 19 May 2023 | Flat 4, The Grange, 65, High Street, Somersham, Huntingdon, Cambridgeshire PE28 3JB | Flat | £105,000 | Leasehold |

| 19 May 2023 | 15, Westhawe, Bretton, Peterborough, City Of Peterborough PE3 8BA | Detached | £573,000 | Freehold |

| 18 May 2023 | 25, Vicarage Way, Trumpington, Cambridge, Cambridgeshire CB2 9NT | Detached | £840,000 | Freehold |

| 17 May 2023 | 44, Roman Way, Godmanchester, Huntingdon, Cambridgeshire PE29 2RW | Terraced | £310,000 | Freehold |

| 17 May 2023 | 17, Weddell Road, Haverhill, Suffolk CB9 0LE | Detached | £330,000 | Freehold |

| 17 May 2023 | 8, Malting Yard, Ramsey, Huntingdon, Cambridgeshire PE26 1DL | Flat | £130,000 | Leasehold |

| 17 May 2023 | 9, Atkinson Street, Peterborough, City Of Peterborough PE1 5HW | Terraced | £180,000 | Freehold |

| 17 May 2023 | 29a, Woodpecker Way, Great Cambourne, Cambridge, Cambridgeshire CB23 6GZ | Semi-detached | £170,000 | Leasehold |

| 16 May 2023 | 37, Listers Road, Upwell, Wisbech, Norfolk PE14 9BW | Detached | £325,000 | Freehold |

| 16 May 2023 | 1, Osprey Road, Biggleswade, Central Bedfordshire SG18 8DZ | Terraced | £315,000 | Freehold |

| 16 May 2023 | 15, Bridge Road, Bedford MK42 9LJ | Semi-detached | £260,000 | Freehold |

| 16 May 2023 | 16, School Road, Terrington St John, Wisbech, Norfolk PE14 7SE | Semi-detached | £140,000 | Freehold |

| 16 May 2023 | 64, Ross Close, Saffron Walden, Essex CB11 4AY | Flat | £265,000 | Leasehold |

| 15 May 2023 | 10, Payton Way, Waterbeach, Cambridge, Cambridgeshire CB25 9NS | Semi-detached | £395,000 | Freehold |

| 15 May 2023 | 8, Mill Road, Impington, Cambridge, Cambridgeshire CB24 9PE | Semi-detached | £575,000 | Freehold |

| 15 May 2023 | 424, March Road, Turves, Peterborough, Cambridgeshire PE7 2DW | Semi-detached | £165,000 | Freehold |

| 12 May 2023 | 22, Granta Terrace, Great Shelford, Cambridge, Cambridgeshire CB22 5DJ | Terraced | £525,000 | Freehold |

| 12 May 2023 | 161, Padholme Road, Peterborough, City Of Peterborough PE1 5JA | Detached | £240,000 | Freehold |

| 12 May 2023 | 3, Pattens Close, Whittlesey, Peterborough, Cambridgeshire PE7 1FA | Semi-detached | £260,000 | Freehold |

| 12 May 2023 | 291, Arbury Road, Cambridge, Cambridgeshire CB4 2JL | Detached | £575,000 | Freehold |

| 12 May 2023 | 9, Hartley Close, Waterbeach, Cambridge, Cambridgeshire CB25 9NG | Semi-detached | £288,000 | Freehold |

These sales illustrate the diversity of properties available in Cambridgeshire and the varying price points in the region.

**Conclusion**

Cambridgeshire’s property market has seen impressive growth over the last year, with detached properties leading the way in terms of popularity and price. As the region continues to attract residents and investors alike, it remains an area of interest for those looking to purchase a property. Whether you’re searching for a spacious detached house or a cozy terraced home, Cambridgeshire offers a range of options to suit different preferences and budgets.