UK Property Market Forecast 2025

A Detailed Analysis of Current Trends and Future Prospects

Executive Summary

The UK property market has demonstrated remarkable resilience throughout 2024, defying earlier predictions of stagnation. Instead, the market has experienced stabilisation and moderate growth, with projections for 2025 indicating further positive momentum. Buoyed by improving economic conditions, falling mortgage rates, and a shift in market sentiment, house prices and buyer activity are expected to climb, although potential challenges such as stamp duty changes and wage growth uncertainties remain on the horizon.

Market Overview: December Trends and Seasonal Adjustments

New seller asking prices have fallen by a seasonal 1.7% this December, equivalent to a £6,395 decrease, bringing the average asking price to £360,197. This decline aligns with the typical pre-Christmas dip, as sellers aim to attract buyers during a period of reduced market activity. Despite this, house prices have ended the year 1.4% higher than December 2023 levels, reflecting overall market resilience.

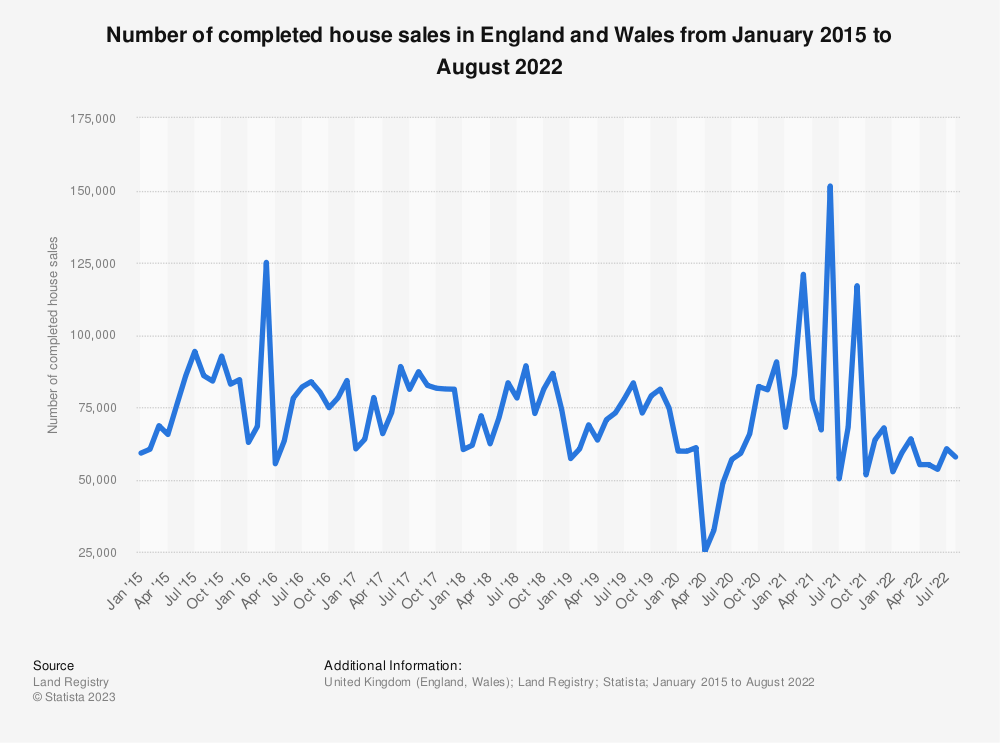

The festive season typically sees reduced activity as buyers turn their attention to holiday preparations. However, this year, activity has remained notably robust, with the number of sales agreed up by 22% compared to the same period last year. Furthermore, new buyer demand has risen by 13%, showcasing a stronger appetite for property acquisitions than was seen in 2023.

The Boxing Day Bounce: A Key Date in the Property Market Calendar

Boxing Day has increasingly become a pivotal moment for the UK housing market. In 2023, a record number of sellers launched their properties for sale on this day, capitalising on renewed buyer interest. Rightmove reported a dramatic 273% surge in buyer demand between Christmas Day and Boxing Day, driven by fresh property listings and increased market activity. This trend is expected to continue in 2024, creating a dynamic start to the New Year.

According to Tim Bannister, Rightmove’s Director of Property Science:

“The 1.7% average monthly fall in December asking prices can be seen as a festive gift for buyers still active in the market. This slight drop in prices serves as a timely incentive for motivated buyers amidst the holiday distractions. Looking ahead, Boxing Day has firmly established itself as a key date for movers. It’s the moment when the Turkey is finished, games are set aside, and mobile phones come out to kick-start property searches for the year ahead.”

Regional Dynamics and First-Time Buyer Market Resilience

While the national market has experienced a seasonal downturn, prices in the first-time buyer sector remain comparatively strong, particularly for homes priced below £300,000. In more affordable regions such as the North East, prices for typical first-time buyer properties have risen by 1.0% this month, contrasting with the national average 1.7% fall. This resilience reflects the sustained demand from first-time buyers who are less affected by stamp duty changes due to the £300,000 exemption threshold.

Conversely, in higher-priced regions such as London and the South East, the looming stamp duty deadline in March 2025 has spurred increased activity among sellers of smaller properties. Many are seeking to complete sales before higher tax rates come into effect. Over the past four weeks, the number of sellers listing two-bedroom homes or smaller in London has risen by 20%, with the South East following at 16%.

2025 Market Forecast: Growth and Emerging Challenges

Rightmove predicts a 4% rise in new seller asking prices for 2025, underpinned by anticipated reductions in mortgage rates. Lower borrowing costs are expected to boost affordability and stimulate further market activity. However, potential challenges include the impact of the 2025 stamp duty changes and broader economic factors such as inflation and wage growth uncertainties.

Key Forecast Highlights for 2025:

- Nationwide Price Growth: Predicted at 2.5–4% year-on-year, depending on regional variations.

- Mortgage Rate Reductions: Expected to improve affordability and buyer confidence.

- Stamp Duty Influence: Likely to create urgency in early 2025 but could dampen activity in higher-priced sectors later in the year.

Affordability and the First-Time Buyer Landscape

Affordability remains a central theme in the property market. First-time buyer homes (defined as properties with two bedrooms or fewer) have shown resilience, with average prices remaining accessible to many. Analysis of average monthly mortgage payments and rents indicates a growing advantage for buyers, particularly as mortgage rates are expected to decline further in 2025.

The affordability to buy a first home is calculated using the Office for National Statistics’ (ONS) Average Weekly Earnings (AWE) data, multiplied by a loan-to-income ratio of 4.5. This provides a benchmark for the typical borrowing capacity of first-time buyers, highlighting the ongoing opportunities in this segment of the market.

Broader Economic Context and Sentiment Shift

The property market’s performance mirrors the broader UK economic landscape, which has displayed adaptability in the face of uncertainty. Aneisha Beveridge, Research Director at Hamptons, notes:

“The mood of the housing market has shifted from trepidation to cautious optimism. Buyers and sellers alike are re-entering the market with greater confidence, buoyed by stabilising prices and improving affordability.”

This shift is reflected in a 25% increase in market activity on platforms such as Zoopla, underscoring renewed buyer engagement and investor interest.

Strategic Recommendations for 2025

For Buyers:

- Act swiftly to take advantage of pre-stamp duty deadline opportunities.

- Focus on regions with strong price growth potential, particularly in the North and Midlands.

For Sellers:

- Leverage the Boxing Day bounce by listing properties early in the New Year.

- Consider market timing carefully, particularly in higher-priced areas facing potential tax increases.

For Investors:

- Diversify geographically to include emerging markets with robust growth indicators.

- Monitor interest rate trends and affordability metrics to identify optimal investment windows.

Summary of UK Property Market Forecast 2025

- New Seller Asking Prices:

- Seasonal drop of 1.7% (-£6,395) in December, bringing the average price to £360,197.

- Prices end 2024 up 1.4% compared to December 2023.

- Boxing Day Bounce:

- Boxing Day 2023 saw record activity, with new sellers and a 273% jump in buyer demand compared to Christmas Day.

- A strong Boxing Day bounce is anticipated in 2024 due to increased buyer engagement and fresh property listings.

- Market Activity:

- Number of sales agreed is up 22% year-on-year, while buyer enquiries have risen by 13%.

- First-time buyer properties are holding prices well, especially below the £300,000 threshold.

- Regional Dynamics:

- Sellers of smaller homes in higher-priced areas, like London and the South East, are rushing to avoid the March 2025 stamp duty deadline.

- Stronger price performance is seen in more affordable regions, like the North East.

- Affordability and Mortgage Trends:

- Anticipated mortgage rate drops are expected to improve affordability and stimulate market activity in 2025.

- First-time buyer affordability remains a key focus, with typical homes under £300,000 less affected by rising taxes.

- 2025 Projections:

- Rightmove predicts a 4% rise in new seller asking prices for 2025, with increased market confidence due to falling mortgage rates.

- Regional growth disparities persist, with Northern Ireland and the North West likely to lead gains.

- Challenges Ahead:

- Stamp duty increases and broader economic factors like inflation and wage growth may temper market activity later in 2025.

Conclusion

The UK property market enters 2025 with cautious optimism, underpinned by strong activity levels, improving affordability, and the potential for further growth. While the looming stamp duty deadline and other economic uncertainties present challenges, the resilience of key market sectors, particularly first-time buyer properties, suggests a dynamic year ahead. Buyers and sellers who act decisively, particularly in regions with stronger growth prospects, stand to benefit most in a market poised for steady progress.