Will the Northampton housing market collapse in 2022

Is the market in danger of freefall?

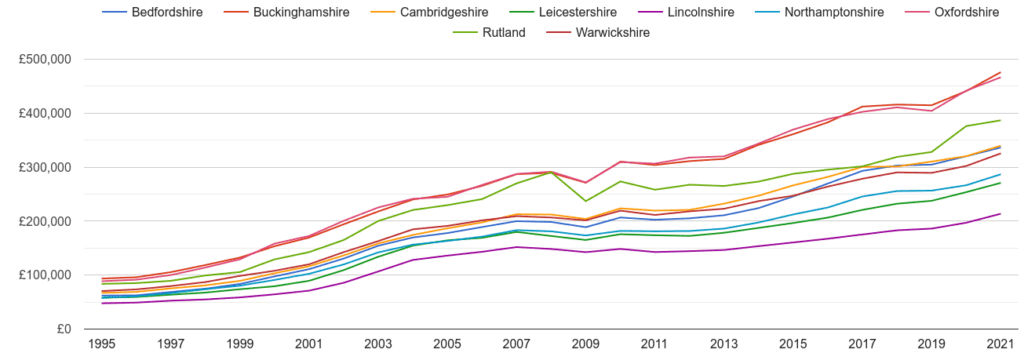

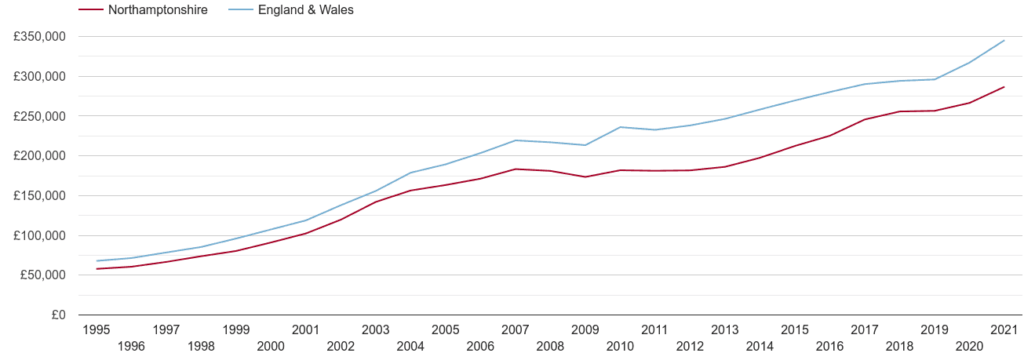

There’s no doubt 2021 was a bumper year for house prices. According to the latest ONS House Price Index, prices increased by nearly 11% year on year. The UK property market was buoyed by low interest rates, the Stamp Duty holiday and changing work habits. But will house prices continue to rise in 2022?

Many experts in the industry believe that house prices will finally begin to fall this year.” That would be welcome news for first-time buyers and upsizers.

Let’s take a closer look at the outlook for house prices in 2022, and reveal the experts’ predictions.

If you were shaken by the inflation figures from the Office for National Statistics, showing the Consumer Price Index in March was up seven per cent year-on-year, I am afraid I have to warn you that there will be more bad news in store next month. City predictions are that it will climb to around 8.8 per cent before falling back a bit through the summer. The number for the retail price index, the traditional measure, was even higher at nine per cent.

But there was another inflation figure published by the Government yesterday, which generated rather less attention. It was higher still: 10.9 per cent. That was the rise in house prices in the year to February. The fact that there was so little apparent concern says a lot about public attitudes to inflation.

Rationally, the amount we have to pay for somewhere to live is just as important as the amount we pay for other necessities such as food and fuel bills. We are ambivalent about house price inflation because for the people who own their homes, rising prices are rather a good thing. Some 65 per cent of households in the UK are homeowners, down from a peak of 71 per cent in 2003. But for most people home ownership would be the tenure of choice.

In 2014 the British Social Attitudes Survey found that given a free choice, 83 per cent would like to own their homes. On the other hand, there was strong push-back against home building, with 45 per cent of people opposing new homes being built in their area. In the south of the country that proportion rose to 50 per cent.

A mountain to climb for young people

There is the problem. We want to own our homes but we don’t want new ones to be built. You don’t need to be an economist to appreciate that if you restrict supply in the face of rising demand, prices are likely to go up. And so it is with homes in the UK. The average price for an existing property is now £266,669 and £352,909 for a newly built one. The average first-time buyer paid £230,593, up 10.1 per cent on a year ago, a sum that for many young people who don’t have family help is a mountain to climb.

So what happens next? Much will depend on the Bank of England and its path of interest rates. They are already on the move, and rose again to 1% yesterday, We will get its quarterly Monetary Policy Report then and that will give us more of a feeling for the future both of inflation and of interest rates. Incidentally, it used to be called the Inflation Report. They changed the name in November 2019, just before inflation began to take off, a shift that looks pretty silly now. I think they should eat humble pie and change it back.

Present surge expected to tail off

But there won’t be much about house prices. What will happen to them? Well, a new set of forecasts have just been published by experts, and the message there is that the present surge will start to tail off from now on.

It appears that three things stand out. One is that nobody is predicting a crash, such as took place after the banking crisis and subsequent recession of 2008-09. The second is that there will be a couple of years, maybe longer, where house prices will rise more slowly than overall inflation. So homes will become more affordable, relative at least to goods and services, and almost certainly to income too. And third, even with this quite sober outlook, prices in 2026 will, at least on average, be 13.6 per cent higher than they are now. This may not be a great time to buy a home, but it is not a dreadful one.

These are brave forecasts from industry experts who deserve credit for their work. The overall message is that buying and selling homes will not bring easy profits, as that has for many people over the past few years. People won’t be boasting that they made more from their house than they did from their jobs. That’s a good thing, for in broad social terms to have homes become more affordable for young people must be right. But a crash would do no good either. I think and hope Knight Frank is right on that one too.

Further thoughts

We’re not expecting a crash in house prices because while interest rates have to rise, they are not heading into the double digits, or anything close, as they did in the 1970s and 1980s. The overall demand for housing in the UK will continue to rise for two main reasons.

One is that the population is increasing and will continue to do so for the foreseeable future. The other is that people need bigger homes as a fair proportion of us will continue to work from them, at least part-time.

What might destabilise the market, overriding these two demand factors, would be distress sellers: people who have to sell fast because they have lost their jobs or because mortgage rates have risen too fast. As yet there is zero sign of the job market going into reverse. We learned this week that unemployment at 3.8 per cent is the equal lowest since 1974-75 and the number of unfilled vacancies at 1,288,000 the highest ever.

The labour market will cool eventually, but that will take time and borrowers will therefore have time to sort out their finances. And as for mortgage rates, the very fact that there is so much debt around means that rates don’t have to go so high to curb inflationary pressures. So a plateau in house prices as wages gradually catch up seems more likely than a sudden fall.

Young central bankers not experienced enough

But it would be right to end with a warning. It is always tricky to end a boom without pushing the economy into a slump, and the present generation of central bankers have no experience of coping with runaway inflation. They are too young. Andrew Bailey, the current governor, joined the Bank of England in 1985, five years after the US Federal Reserve had famously increased its interest rate to 20 per cent, thereby knocking inflation on the head – but causing a recession.

The present generation – and this is not to get at the Bank of England in particular – have allowed the worse inflation for 40 years. The question is, do they have the judgement to curb it now without triggering another recession?

Conclusion

It is unlikely that prices will head south in a significant way, although there will definitely be a correction and isolated minor falls in prices, overall, the market will remain strong. Rents have been increasing, which will ensure they keep pace with rising house prices and only one third of UK homes are mortgaged, with another third being owned outright and the other third being rented. Of the third that are mortgaged, many of them are on fixed deals which should see them through this year and in to next year, by which time the current rises in prices will begin to fall of the RPI, provided that inflation does not spiral out of control, the risk of anything dramatic is negligible.