key takeaways from Labour’s first 50 days in office

A Comprehensive Analysis of Property and Housing Initiatives

Following the first fifty days of Labour’s administration, the property sector has witnessed numerous significant policy pronouncements. This analysis examines the key pledges and their potential implications for the British housing market.

## “Get Britain Building Again” Campaign

The cornerstone of Labour’s housing strategy centres on an ambitious pledge to construct 1.5 million new homes over the coming five-year period. This declaration has garnered mixed reactions from industry specialists and economists alike.

### Implementation Strategy

Labour’s proposed methodology encompasses several key elements:

– Reintroduction of mandatory housing targets for local authorities

– Prioritisation of brownfield and “grey-belt” development sites

– Comprehensive reform of planning processes

– Preferential access for local residents and first-time buyers regarding affordable and social housing schemes

### Industry Response

The announcement has prompted varied responses from sector experts. Neil Jefferson, Chief Executive of the House Building Federation, expressed optimism to the Financial Reporter, suggesting that Labour’s proposed planning reforms directly address what he considers the primary constraint on recent housebuilding efforts.

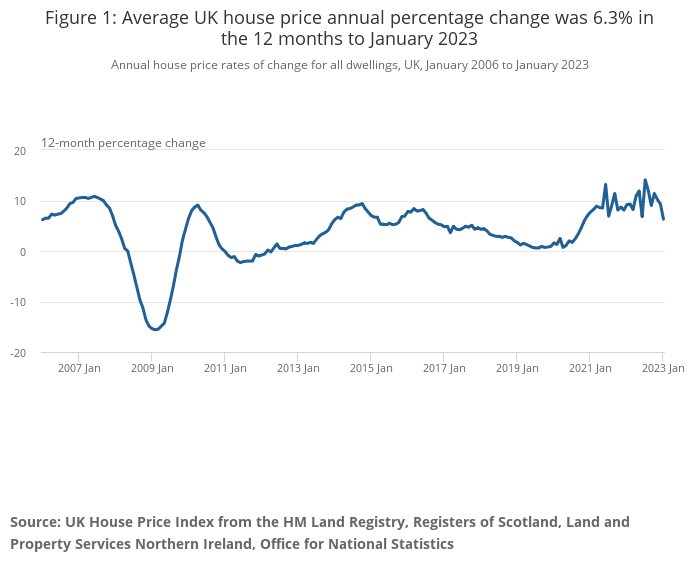

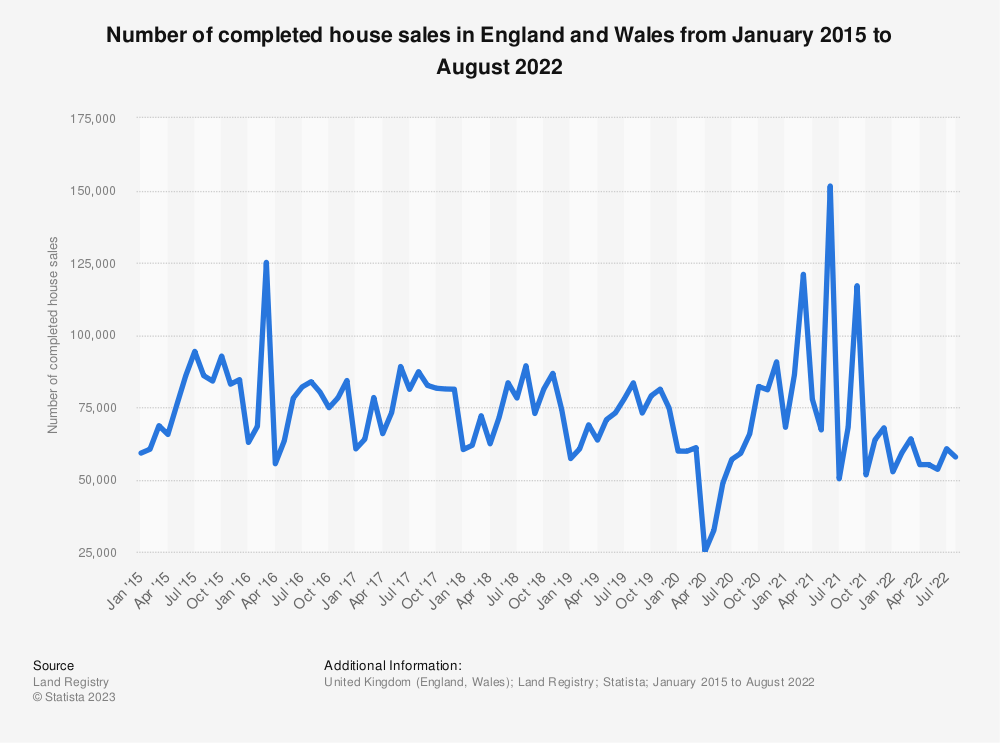

However, The Economist’s detailed analysis presents a more nuanced perspective. Their econometric modelling, which considered current construction rates, interest rate trajectories, and demographic trends, suggests the initiative may have minimal impact on overall house prices in isolation. Nevertheless, they acknowledge the potential for more substantial long-term effects should this increased construction rate persist beyond the initial five-year period.

John Doyle, Head of New Homes at OnTheMarket, offered a measured assessment:

“The weeks following Labour’s electoral victory have proven particularly noteworthy for the new homes sector. The 1.5 million homes commitment presents considerable opportunities, particularly given our well-documented housing supply shortfall.

“Nevertheless, enhanced opportunity brings commensurate pressure. Local authorities will face specific numerical and temporal targets, whilst maintaining exacting standards regarding quality and specification across all demographic segments, from first-time buyers through to retirement accommodation.

“The coming five-year period will reveal what equilibrium can be achieved and its broader impact on the housing market landscape.”

## National Planning Policy Framework Reforms

To facilitate their ambitious housing targets, Labour has announced comprehensive reforms to the National Planning Policy Framework (NPPF). These modifications aim to streamline and expedite the planning permission process.

### Key Reform Elements

The proposed reforms encompass:

– Reinstatement of mandatory housing targets

– Enhanced accessibility to brownfield and “grey-belt” sites

– Introduction of “golden rules” for green-belt development, stipulating:

– 50% affordable housing requirement

– Mandatory environmental enhancement

– Sufficient infrastructure provision

Additionally, Labour has committed to appointing 300 new planning officers to bolster application processing capabilities.

### Expert Perspectives

While property developers have largely welcomed the streamlined planning processes, academic experts have raised pertinent concerns. Urban Planning professors from the University of Manchester emphasise the crucial importance of experience and meticulous attention to detail when evaluating large-scale development proposals. They highlight potential risks regarding:

– Housing quality and safety standards

– Environmental impact assessment

– Infrastructure capacity evaluation

## Renters’ Rights Reform

Labour has committed to advancing the previous government’s Renters’ (Reform) Bill, whilst incorporating additional protective measures for tenants.

### Principal Elements

The enhanced legislation aims to:

– Abolish no-fault evictions

– Establish mechanisms for tenants to challenge rent increases

– Prohibit rental bidding wars

– Extend Awaab’s Law to encompass the private rental sector, introducing penalties for landlords who fail to address damp and mould issues promptly

### Stakeholder Concerns

The British Landlords Association has expressed reservations, suggesting these measures could potentially diminish investor confidence in the rental market. They warn of possible unintended consequences, including:

– Existing landlords divesting their portfolios

– Reduced investment in rental properties

– Potential contraction of available rental stock

## Energy Efficiency Initiative

The government has allocated £6.6 billion over five years towards improving energy efficiency across five million homes, representing a significant commitment to environmental sustainability and cost-of-living reduction.

### Implementation Framework

The scheme will operate through:

– Direct government grants

– Subsidised low-interest loans

– Collaborative partnerships with:

– Local authorities

– Devolved administrations

– Private sector financial institutions

## Educational Policy Impact on Property Markets

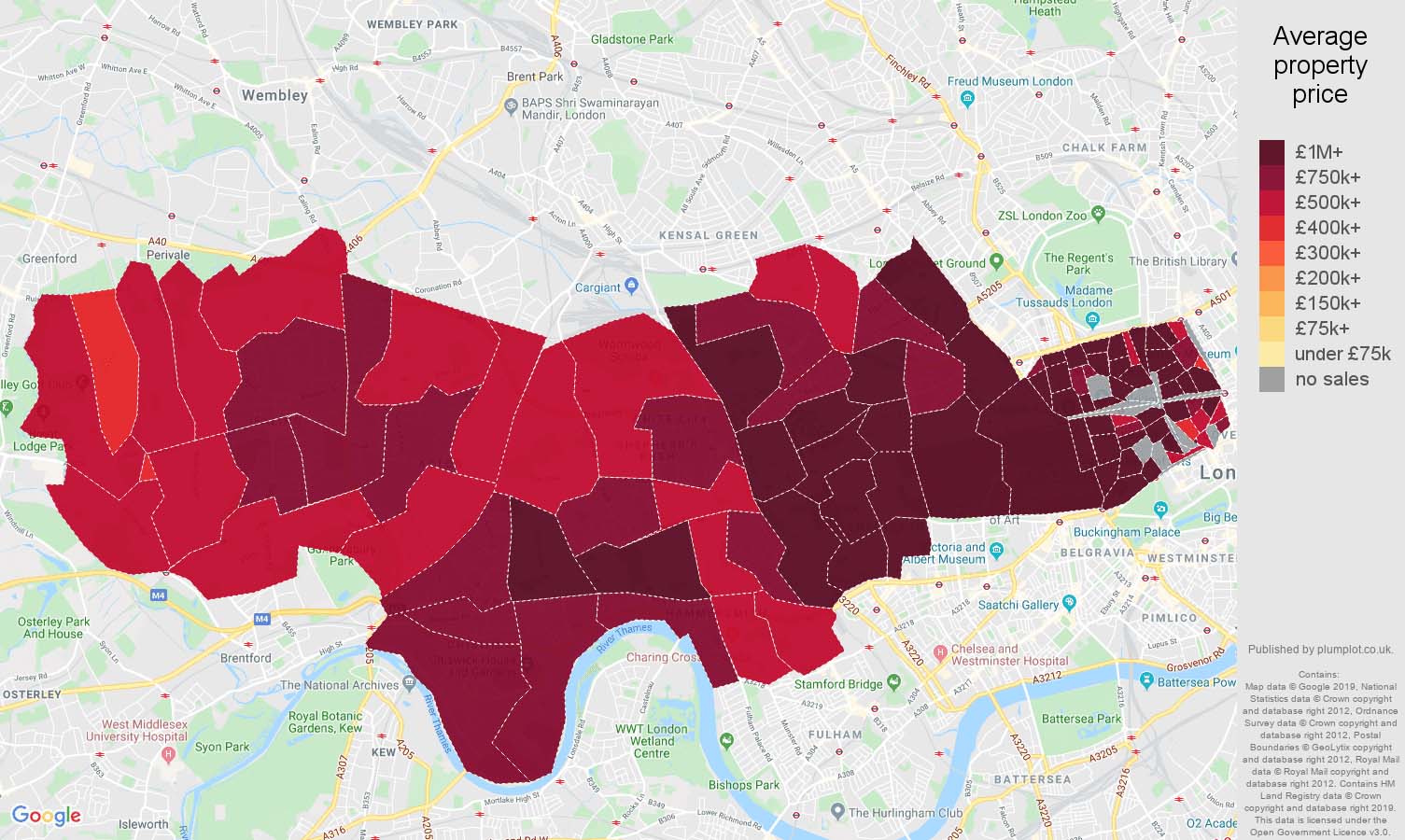

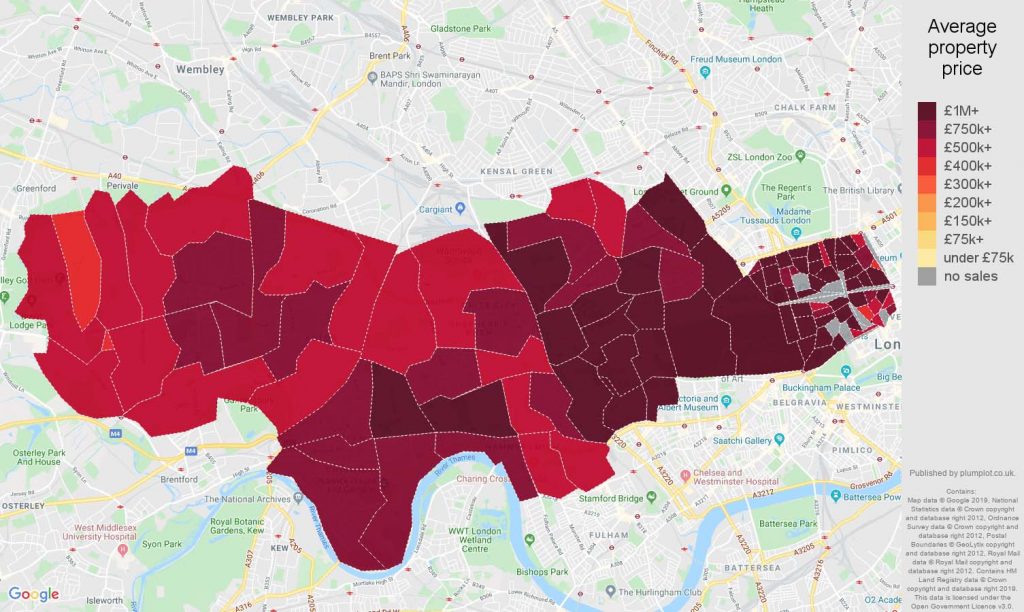

Labour’s proposal to remove private schools’ charitable status has already influenced property market dynamics. OnTheMarket data reveals substantial increases in property searches near prestigious grammar schools:

– King Edward VI Camp Hill (Birmingham): 166% increase

– Dartford Grammar School (Kent): 151% increase

– Various London locations: >100% increase

This trend may intensify as the January 2025 implementation date approaches, potentially driving localised price appreciation in affected areas.

## Forward Outlook

Whilst fifty days represents a significant period in political terms, the government faces nearly five years of implementation challenges ahead. The ambitious scope of their proposals has generated considerable discourse across industry sectors. The forthcoming Autumn Budget is eagerly anticipated for additional detail regarding:

– Specific funding mechanisms

– Implementation timelines

– Performance metrics

– Regulatory frameworks

As these initiatives progress from policy to implementation, their success will ultimately be measured against their stated objectives of increasing housing accessibility, improving rental sector conditions, and enhancing energy efficiency across Britain’s housing stock.