Northamptonshire Property Market Update – July 2023 NN11

**House Prices in NN11: A Year in Review**

If you’ve been keeping an eye on the property market in NN11, you’ll undoubtedly be intrigued by the latest figures. Over the past year, the real estate landscape in this region has shown significant growth and development. In this blog post, we’ll dive into the statistics and explore the key trends that have shaped house prices in NN11.

**Average House Prices**

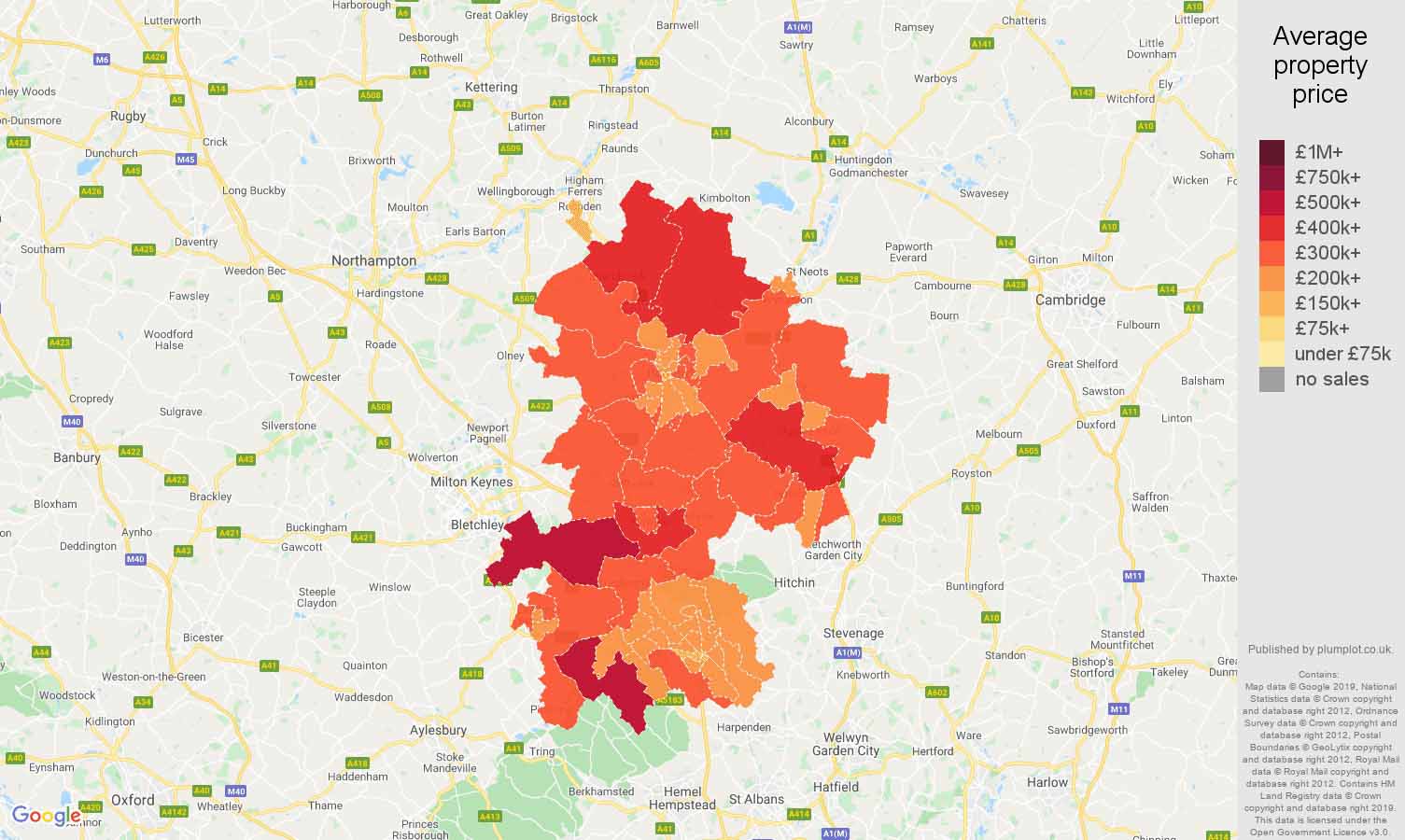

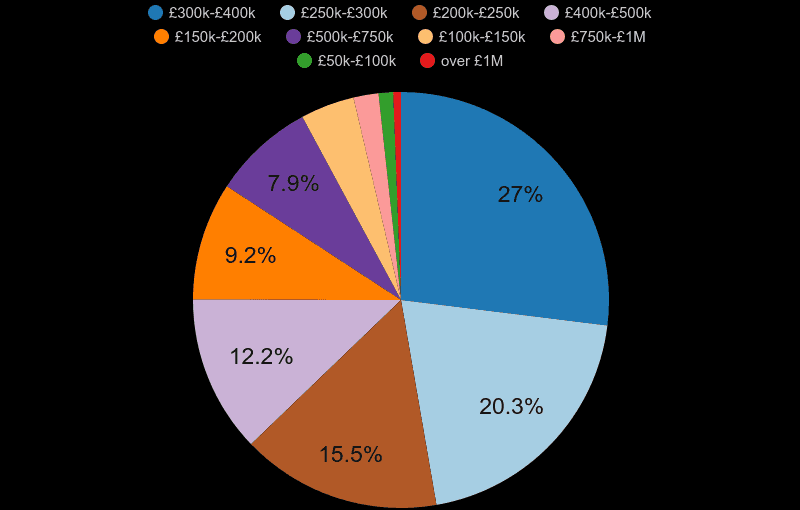

First and foremost, let’s look at the overall average house price in NN11 over the last year. According to the data, properties in this area commanded an impressive average price of £325,194. This figure provides a valuable glimpse into the general state of the local property market.

**Property Types and Prices**

One interesting aspect of the NN11 housing market is the variety of property types available. Among the most prominent sales in the area during the past year were detached properties, which fetched an average price of £461,155. These detached homes seem to be highly sought after, likely due to their spaciousness and privacy.

Coming in behind detached properties were semi-detached homes, which sold for an average of £293,017. Those looking for a more budget-friendly option might have found terraced properties appealing, with an average price of £243,871.

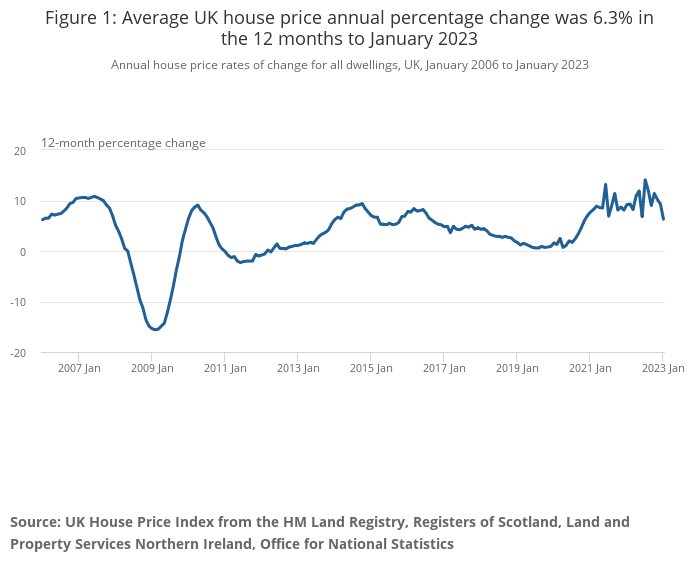

**Growth and Historical Comparison**

The NN11 property market has also experienced growth in terms of prices. Sold prices over the past year were 8% higher than the previous year, showcasing a robust increase in property values. Furthermore, the market saw an impressive 16% surge compared to the peak in 2020 when the average price stood at £279,961. This upward trend indicates a healthy and flourishing real estate landscape in NN11.

**Noteworthy Sales**

Let’s take a closer look at some notable property sales in NN11:

1. **Howletts End, Croft Lane, Staverton, Daventry, West Northamptonshire NN11 6JE**

– 4 bed, detached

– Sold for £625,000 on 12 May 2023

– Freehold

2. **Old Mill House, Banbury Road, Moreton Pinkney, Daventry, West Northamptonshire NN11 3SQ**

– Detached

– Sold for £870,000 on 11 May 2023

– Freehold

3. **15, Clarkes Way, Welton, Daventry, West Northamptonshire NN11 2JJ**

– 5 bed, detached

– Sold for £755,000 on 28 Apr 2023

– Freehold

– Previous sales: £550,000 on 16 Oct 2015, £530,000 on 1 Apr 2011

These sales exemplify the diverse range of properties and prices in NN11, from stunning detached homes to more affordable semi-detached and terraced properties.

**Conclusion**

The NN11 property market has undoubtedly been on an upward trajectory over the past year. With an overall average price of £325,194 and various property types available to suit different needs and budgets, this region offers a promising investment and residential landscape. Whether you’re a potential buyer, seller, or simply curious about the real estate market, the figures and trends in NN11 are certainly worth keeping an eye on. As we move forward, it will be exciting to see how the housing market in this area continues to evolve.