Northampton property market update June 2022

There is growing speculation that the government is planning to encourage pensioners to downsize by offering a stamp duty tax break. The move would be a welcome one, according to the National Association of Property Buyers (NAPB) as it would potentially increase the supply of larger properties coming onto them market. It is estimated that almost four in ten properties are officially ‘under-occupied’, meaning they have too many bedrooms for those living there, and could be more effectively used by families with children.

Jonathan Rolande, from the National Association of Property Buyers (NAPB), said: “We’d welcome a stamp duty cut for pensioners selling their own home to downsize. It would allow them to move without the penalty of high SDLT and would certainly encourage more to do so.

“Currently a pensioner selling a family home at £700,000 to buy at £500,000 would face a £15,000 stamp duty bill and with other costs such as estate agent and solicitors a move downward is going to cost them nearly £30,000 – a figure many simply cannot bring themselves to pay when leaving a much loved family home.

“Government receipts from stamp duty have more than doubled in the last ten years so there is certainly capacity to offer targeted reductions to help free up stock.”

Buy-to-let landlords could also be given incentives, such as lower capital gains tax, to sell their second homes to first-time buyers. But Rolande fears that this measure could backfire. He added: “We strongly disagree with any plan to reduce taxes for landlords who sell to first time buyers,” he added.

“The last thing we need right now is fewer properties to let, penalising those not in a position to buy their home. If tax breaks for wealthy landlords are on the table, why not use them to incentivise those who let their property on longer term agreements, giving more security to hard pressed tenants?

“We’re very glad that the government is looking at measures to repair parts of the broken property market but I am fearful that ill-considered action to solve one problem here will create another issue elsewhere.”

The government needs to seriously consider its position on Stamp Duty. As house prices have risen, more and more properties have approached the higher Stamp Duty rates, creating a glass ceiling, that is discouraging people from moving upwards. People in the UK are used to moving home, to move upwards, outwards or near to another job, but the punitive rates are punishing those who by moving are contributing the economy in a very significant manner.

The volume of property for sale is at an all time low, onw of the factors contributing to this is that as the chain of sales has worked its way upwards, there comes a point where it is just too uneconomical for people to move upwards, which would make their home available for those lower down the ladder to also move. The exchequer is collecting less tax from the top 5% of properties today, than before they increased the rates, making their logic unclear.

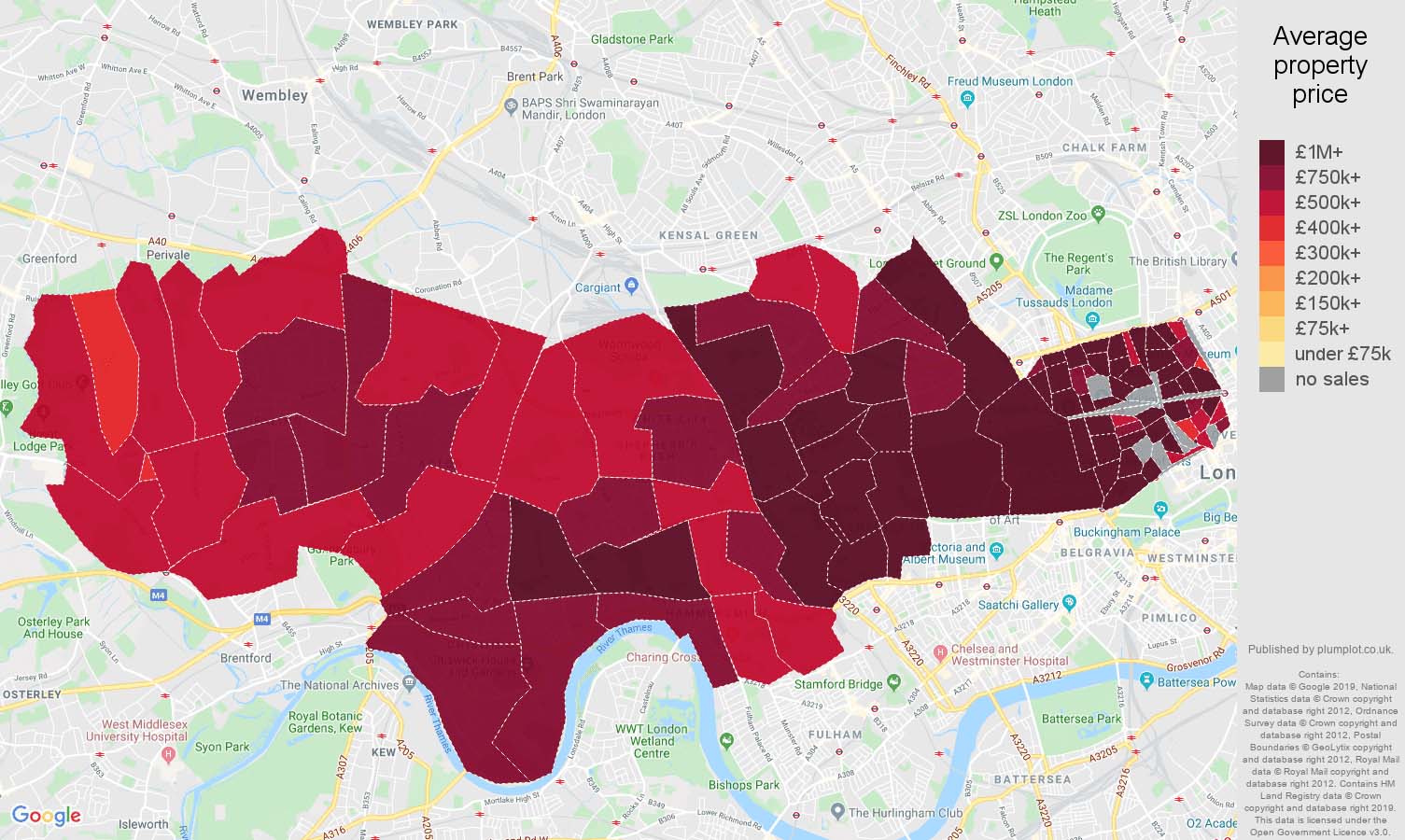

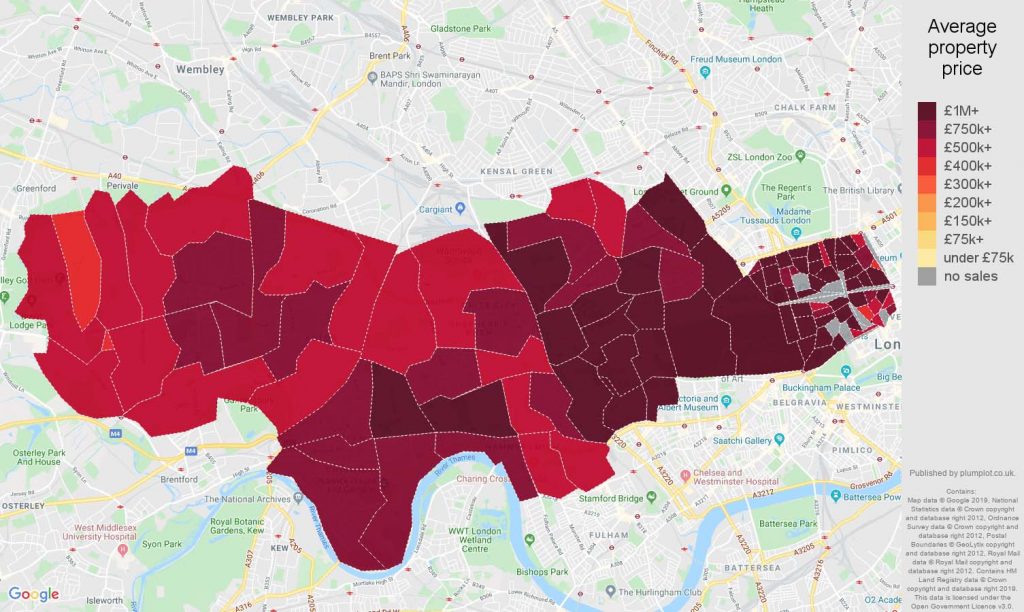

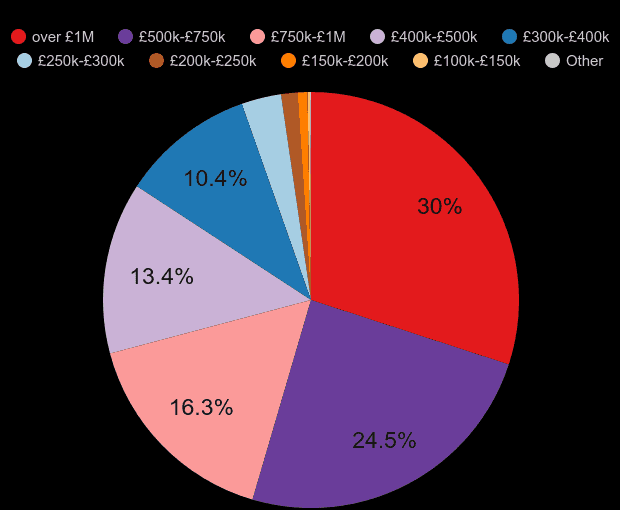

The average property price in West London postcode area is £1.1M. The average price declined by £-190.1k (-14%) over the last twelve months. The price of an established property is £1.2M. The price of a newly built property is £702k. There were 5.5k property sales and sales increased by 9.2% (497 transactions). Most properties were sold in the over £1M price range with 1650 (30.0%) properties sold, followed by £500k-£750k price range with 1348 (24.5%) properties sold.

| West London postcode area | England and Wales |

| £1.1M | £342k |

| average property price | average property price |

| -14% | 5% |

| average price percentage change | average price percentage change |

| £-190.1k | £15.8k |

| average price change | average price change |

Official data for January reveals the average price fell by 1.8% to £510,102

London’s property market is “overvalued” by as much as 50% and this has raised fears of a “looming correction”, The Telegraph reported.

S&P Global Ratings, an American credit rating agency, told the paper that “a combination of low rates, the stamp duty holiday and excess savings amid the pandemic have driven property prices higher, particularly in London and the South East”. Researcher Alastair Bigley warned that prices were likely to fall. “We expect a greater correction in property prices in an overvalued market,” he said. Meanwhile, outside London, S&P estimated that property was overvalued by 20%.

According to the latest house price index issued by property website Rightmove, the average home in London now costs £664,400. And the average time it takes to sell a home in the capital dropped from 68 days to 57 days in February – “another sign activity is picking up”, said the London Evening Standard.

Rightmove’s data also revealed that the UK house price average is now £354,564 – the first time it has exceeded £350,000.

The average property value in London was £510,102 in January 2022 – down 1.8% from December 2021, according to official data published by the HM Land Registry and the Office for National Statistics (ONS).

Regional data from the house price index revealed that London saw the lowest annual price growth, an increase of 2.2%, and the 1.8% dip was the most significant monthly price fall.

The London property market is one of the most robust markets in the world. The market is still being affected by a combination of factors that will take a long time to balance out.

Firstly there was Brexit, which resulted in less demand for housing in the capital, as many companies and workers either put their plans on pause, pending a clearer picture of how leaving the EU will change things, then there was the lockdown, a once in a lifetime event that came out of nowhere, forcing companies to switch to a work from home policy that changed the demographics significantly and with many workers still not travelling in to work, the city is still not back to normal.

Another consequence of the lockdown, was the number of EU workers who decided to leave, figures suggest that this may have been up to one million in London alone. This was then followed by constant uncertainly about the pandemic and to top it all, February the 24th saw the invasion of Ukraine by Russia, which has resulted in a significant fall in investment from the Russian market as sanctions were imposed. This happening at the same time as high inflation caused by the bounce-back along with the first interest rises in a long time, as the markets deal with massive price rises, due to delays in the supply of materials around the world, post-pandemic.

Despite all these factors, which are referred to as the ‘perfect storm’ London is still holding up relatively well and there will no doubt be a striking point where investors will begin to enter the market in larger numbers, placing their money in to one of the safest markets in the world.