How to keep your buy-to-let afloat AND help tenants in the lockdown: From rent cuts to mortgage holidays?

The government has amended the eligibility criteria and will allow some agents’ commission payments to be included in claims for Furloughed Pay.

An announcement came via NAEA and ARLA Propertymark which has received clarification from the government. A joint NAEA/ARLA statement says:

The clarification states that agents will be able to claim for any regular payments that they are obliged to pay employees including

– wages;

– past overtime;

– fees;

– compulsory commission payments.

Discretionary bonuses and commission payments however, and non-cash payments cannot be included.

In circumstances where the employee has been employed for 12 months or more, you can claim the highest of either:

– the same month’s earning from the previous year;

– average monthly earnings for the 2019-2020 tax year.

Where the employee has been employed for less than 12 months, employers can claim for 80% of their average monthly earnings since they started work.

The scheme is in place from 1 March 2020 for 3 months and may be extended if necessary. To be eligible for the grant, a furloughed employee must have been enrolled on the company’s PAYE payroll and cannot undertake work for, or on behalf of, the organisation. Staff who are working reduced hours are not eligible for pay to be reimbursed.

Where an employee has been made redundant on or after 28 February 2020, agents can re-employ them, put them on furlough and claim for their wages through the scheme.

A furloughed employee is free to take part in voluntary work if this is in line with public health guidance, as long as they are not providing services for their employer.

Furloughed employees are free to participate in training and this is encouraged as long as it is not part of work to generate income for the organisation within the furlough period.

Over the last two weeks we’ve seen the country come to a standstill and the property market effectively put on ice until we are out of lockdown.

The next few months are going to be incredibly difficult for everyone, but it is vital that agents take this time to start planning for the future. Taking the right steps over the next few weeks will be key to ensuring that you’re ready to hit the ground running as soon as some of the current restrictions are lifted.

Unlike after the last recession, current predictions are that the market could recover relatively quickly, but what evidence do we have to support that theory?

Following the General Election in December, pent up demand from people who had been holding back due to Brexit uncertainty, flowed into the marketplace. Could that stand us in good stead for a quick recovery?

Let’s look at the figures…

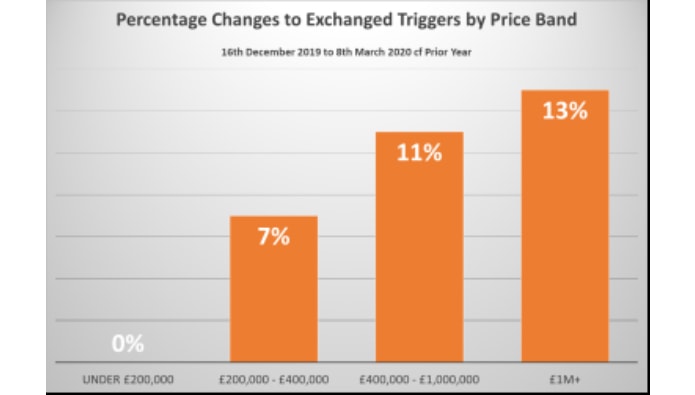

The data – exchanges

Looking at the change in volumes of Exchanged triggers, we can see that the largest increase in exchanged properties came from the £1 million+ price bracket, with property prices from £400,000 to £1 million not far behind.

Both top brackets were experiencing unprecedented double digit growth year-on-year.

In addition, the £200,000 to £400,000 price bracket was also seeing a very healthy growth in exchanges year-on-year.

You could, however, make a strong argument to suggest that a large portion of this effect was not as a result of electoral stability, because it takes so long to complete a property purchase.

Looking at the volume of changes in sales agreed (or SSTC) would perhaps provide an even better view of what happened in the first few weeks of 2020 compared with the prior year.

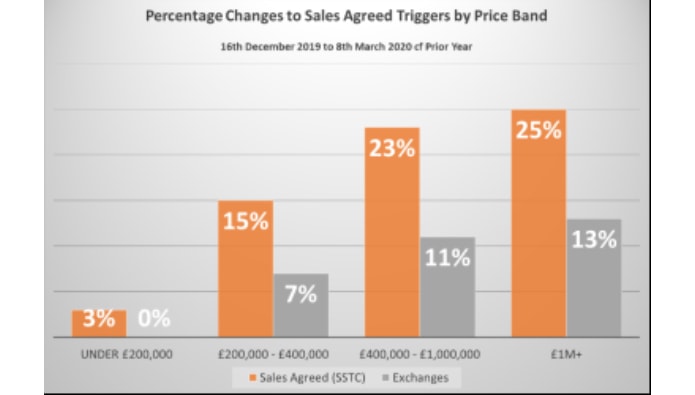

The data – sales agreed

This chart adds the Sales Agreed (or SSTC) trigger changes to the Exchanged triggers and it certainly makes interesting reading.

Firstly, we can clearly see that the changes to SSTC volumes were far more dramatic in all price brackets – roughly double the growth in exchanged triggers.

In properties above £400,000, we were seeing north of 23% growth and the £200,000 to £400,000 bracket, a more than healthy 15% growth in sales agreed.

The only slight downside is that the sales agreed growth rate in properties under £200,000 was comparatively very low.

The high street agent effect

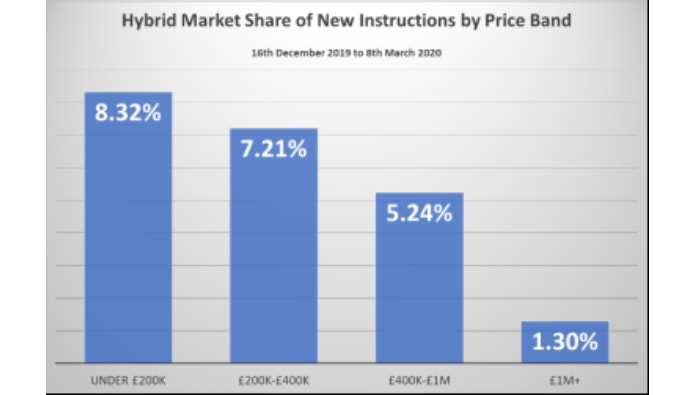

Now let’s look at the market share of high street agents versus hybrids (those without a traditional branch network).

The market share of new instructions by price bracket for hybrid agents is shown in this chart.

What we see here is that a hybrid agent’s market share was highest in the poorest price bracket where sales agreed volumes were growing much slower year-on-year than they were in the other three price brackets.

This means that the benefit of the increase in sales seen since the election of 2019 will have been disproportionately felt by the more traditional high street estate agent.

Of the growth in sales that has been experienced to date in the £200,000 to £400,000 selling price bracket, nearly 93% of this will have gone to high street agents.

As we move onto the £400,000 to £1 million selling price bracket, just under 95% of the benefit will have gone to high street agents.

And finally, in the specialised £1 million plus selling price bracket, nearly 99% of the benefit will have flowed through to high street agents!

So what does this mean for the future?

Unfortunately, no-one knows how long lockdown will continue or indeed, exactly what the future of the property market looks like. However, looking at the performance of the market up until mid-March 2020 tells us a few things;

– A high volume of people actively wanted to move

– This was most prevalent for properties in the £200k+ price bracket and even more so at £400k+

– The majority of this activity was taking place with high street agents

Although unfortunately some of these agreed sales will recently have fallen through and many properties will now have been withdrawn from the market, the likelihood is that most of these people will still want to move once they are allowed to.

This should create increased demand on available stock, thereby encouraging more new instructions. The best news is that once these vendors do return to the market, sales should continue to be high value and skewed towards high street agents.

What can you do in the meantime?

It is essential that you maintain contact with those vendors either already on the market, or who have recently withdrawn – both your own and those of your competitors.

Now, more than ever, you must look after your pipeline so that you’re not starting from scratch when the market inevitably picks back up.

This is an opportunity to establish a ‘trusted advisor’ relationship with these vendors, offering them help and guidance when their future move now seems uncertain.

At times like these how you treat your customers and potential customers is paramount. They will need far more hand-holding and direct communication. Some agents are not going to do this and, as such, we are likely to see even more agent switching once we are out of lockdown as vendors become frustrated with a lack of support from their existing agent.

It is vital, though, that what you’re sending is sensitive to the current situation and you don’t just continue to send the same message as you would have done a few weeks or even days ago.

Now that you’re not spending your time on the usual day-to-day tasks use it as an opportunity to really work on the content of your communications and make sure the messages you send highlight the changing requirements of the current marketplace.

Talk about the services you offer that can help vendors restart their property sale as quickly as possible once we’re out of lockdown; share your plans on;

– Virtual tours

– Accompanied remote viewings

– Floor plans

– Live streaming of ‘virtual open houses’

– Online auctions

– ‘Little Black Books’ promoting ‘the best kept secrets’ or houses not openly marketed and see if sellers want to be on it

A leading human resources expert predicts that agents who are poorly treated by their employers now will wreak revenge and move elsewhere when the virus subsides.

Recruitment guru Anthony Hesse, managing director of Property Personnel, says that when some form of normality returns “Those who have been treated poorly by their current employers won’t forget the experience in a hurry, and will start to look for other jobs – either within the industry or elsewhere.

“I expect to see a seismic shift in people moving around from job to job, and from profession to profession, with some of them making the move to becoming self-employed. Inevitably, a number of experienced and talented staff will leave, who we will be sad to see go and will be hard to replace.”

He says that one of the lasting legacies of this outbreak will be an increased understanding of why a good work/life balance is so important – and he forecasts that those agencies that recognise this will retain and attract the best staff.

“Over the past week or so of lockdown, I’ve been speaking to a number of senior directors in the big estate agency firms … the perspective I’ve been getting is that we are inevitably going to see some massive restructuring taking place in the estate agencies of the future.

“Most obviously, a new awareness of just what technology can do is going to drive decision making going forward. The ease and speed with which people have taken to communication platforms such as Zoom, Skype, and Messenger – and some of these individuals doing so for the first time – mean that virtual viewings and even virtual valuations could become the norm.

“Directors will ask why their agency doesn’t do more of what worked so successfully during time under lockdown. This means that operations are likely to be streamlined, and people previously brought in as temporary staff – such as those carrying out viewings at weekends, for example – might find that their workloads have melted away.

“Similarly, agencies with several branches across a relatively small geographic area will decide that a single office can do the job of three, with significant cost savings as a result.”

Hello and welcome to our latest update… we’re probably not yet getting used to these unusual times but we hope this daily service helps provide some guidance.

First off today, Right To Rent’s new Coronavirus changes.

Letting Agent Today ran a story earlier this week on how Right To Rent is being relaxed during the current crisis, and now the Association of Residential Letting Agents has published a short guide on how to conduct a check on a prospective tenant.

– Ask the tenant to submit a scanned copy or a photo of their original documents via email or using a mobile app;

– Arrange a video call with the tenant – ask them to hold up the original documents to the camera and check them against the digital copy of the documents;

– Record the date you made the check and mark it as “an adjusted check has been undertaken on [insert date] due to COVID-19”.

If the tenant does not have the right documents you must contact the Landlord’s Checking Service if the tenant cannot provide documents from the prescribed lists.

These measures remain in place until the point when government announce a return to previous arrangements. After that, agents must revert to existing processes.

Within eight weeks of the temporary measures being lifted, agents will also need to carry out full retrospective checks on tenants who:

– Started their tenancy during this period;

– Required a follow-up check during this period.

ARLA says that in these cases, it is essential to keep records of both checks and if the retrospective checks reveal a tenant who should not have entered/continued a tenancy, follow the processes to end the tenancy.

And the association adds: “Please note that because of COVID-19 some individuals may be unable to evidence their Right to Rent and therefore it is vital that agents remember the processes within the code that are in place in order to avoid discrimination.”

Something unusual next – virtual staging.

Many agents, especially in London, ‘stage’ empty properties to enhance their appeal. Expert advice is difficult to get in person during the lockdown but Elaine Penhaul, owner of Lemon and Lime Interiors, is offering two services tailored for the current situation.

The two – virtual home staging and remote staging – will allow vendors and agents to get properties in the right position for a quick sale once the market recovers later in the year.

Elaine, who started staging in 2012 and set up the company in 2015, says: “As an agent you want to help those vendors who have a property they need to sell, to be the first to secure good offers when the market picks up later in the year. This new service allows us to help agents offer vendors the perfect solution whilst we are not able to be out and about.”

The virtual home staging service allows vendors and agents to take a high-resolution picture of an empty room and send it to Lemon and Lime Interiors. The team then virtually fill the room with an interior design scheme and luxury furnishings to make the property looked lived in, which in turn, will help people to visualise themselves living in the property.

All the furniture used is available to purchase so the whole scheme can be bought by whoever buys the house should they wish.

The remote home staging service offers homeowners the chance to have a video call with the Lemon and Lime team of experienced home stagers to learn how to present their home to attract the most interest.

Once any decluttering or rearranging has been done, the homeowner can take photos which can be professionally edited through Lemon and Lime ready to be uploaded to the property portals. Properties already on the market can improve their presentation and appeal in this way and it allows new properties to come to the market with the benefit of professional staging.

Hello and welcome to the latest edition of Conquering Corona, our daily update helping the industry cope with the current crisis.

If you have appropriate advice to share with the industry, please email us on press@estateagenttoday.co.uk and we’ll let other agents and suppliers see it too.

Firstly today there’s an offer by high-profile free to list portal Residential People, which is allowing agents to enjoy all its premium features and advertising for free whilst the pandemic is ongoing – additionally, existing customers will have their contracts extended.

Residential People’s ‘featured property’ listing offers agents the ability to exclusively advertise within a desired location, and gives them access to an online marketing suite. You can see more here.

“The Coronavirus has had a drastic impact on the livelihood of estate agents and businesses across the UK” says Residential People sales and managing director, Roy Bartolo.

Now news of a survey by the lettings trade body the Residential Landlords Association; it’s asking members a series of question on the impact of Coronavirus.

There’s been a strong response so far, so if other RLA members want to participate – and it’ll take just a few minutes – you can click here.

Now an idea put forward by London agent Kristjan Byfield, who is urging agents to undertake regular live events online where they can share their knowledge and experience.

He’s called in the #AgentsHereToHelp initiative and hopes the idea will lift agents’ spirits during the crisis as well as share ideas.

Some 20 agents have already signed up including David Lee, Keller Williams, Fine & Country*, Roseberry Newhouse, Danelaw Real Estate, Maurice Kilbride, NestledIn, Normie & Co, Jackie Oliver & Co, McDowalls, Mr Green, Ferndown, Robinson Michael & Jackson, Logic Estates, GoView, Dreamview, Stones and Belvoir, as aeell as Kristjan’s own agency base property specialists.

He wants to launch this campaign in the next week and has set up a registration form for agents to complete – you can see it here.

It’s been reported that the government is talking with banks and building societies about putting the housing market ‘on ice’ during the virus crisis to avoid a crash and to allow financial institutions to offer mortgages.

Today’s Financial Times says UK Finance – the trade body representing mortgage lenders – has told members: “UK Finance has been seeking urgent clarification from the government about whether home purchases should continue at the current time, particularly as physical property valuations are no longer possible.”

One suggestion is that offers of mortgages in principle could extend to six months rather than three.

The FT story follows growing concern yesterday that many mortgage lenders were withdrawing their products or severely restricting access to them; this was thought to be because valuations were not possible ‘in person’, and because of uncertainty that homes would retain their value over the coming months.

Lloyds Banking Group and Barclays, two of the UK’s biggest lenders, are temporarily pulling many of their mortgages. Lloyds has stopped offering mortgages or remortgages through brokers unless the customer has a deposit of at least 40 per cent of the value of the property.

Barclays told brokers it would no longer offer mortgages for customers that did not have a deposit of at least 40 per cent, but it will continue to offer remortgaging deals.

Last evening the Housing Secretary, Robert Jenrick, took to Twitter to say: “I know that many people across the country are due to move house tomorrow. Whilst emergency measures are in place, all parties should do all they can to agree a new move date. If you’re socially isolating or being shielded, it’s especially important to try and delay.”

And this was followed up by tweets from the MHCLG saying: “People should delay moving where possible … Estate agents must work remotely to support their clients … If your home is on the market, you shouldn’t let buyers visit your home.”

Earlier this week the Ministry of Housing, Communities and Local Government had advised buyers and renters to, if at all possible, delay moving home until the Coronavirus crisis has subsided.

The same guidance also allows tradespeople to continue repairs and maintenance work, “provided that the tradesperson is well and has no symptoms.”

“No work should be carried out in any household which is isolating or where an individual is being shielded, unless it is to remedy a direct risk to the safety of the household, such as emergency plumbing or repairs, and where the tradesperson is willing to do so.”

The government has at last issued extensive advice on home moving and the activities of estate agents during the continuing Coronavirus crisis.

This came last evening after days of debate on how much marketing, valuing, viewing and conveyancing could be done during the lockdown.

Here is the guidance in full:

There is no need to pull out of transactions, but we all need to ensure we are following guidance to stay at home and away from others at all times, including the specific measures for those who are presenting symptoms, self-isolating or shielding. Prioritising the health of individuals and the public must be the priority.

Where the property being moved into is vacant, then you can continue with this transaction although you should follow the guidance in this document on home removals. Where the property is currently occupied, we encourage all parties to do all they can to amicably agree alternative dates to move, for a time when it is likely that stay-at-home measures against coronavirus (COVID-19) will no longer be in place.

In the new emergency enforcement powers that the police have been given to respond to coronavirus, there is an exemption for critical home moves, in the event that a new date is unable to be agreed.

Recognising parties will need to alter common practice, we have sought to ease this process for all involved by:

- Issuing this guidance, developed with Public Health England, to home buyers and those involved in the selling and moving process;

- Agreeing with banks that mortgage offers should be extended where delay to completions takes place in order to prioritise safety; and,

- Working with Conveyancers to develop a standard legal process for moving completion dates.

Advice to the public

What does this mean for my property move which is scheduled whilst the stay-at-home measures to fight coronavirus (COIVD-19) apply?

- Home buyers and renters should, where possible, delay moving to a new house while measures are in place to fight coronavirus (COVID-19).

- Our advice is that if you have already exchanged contracts and the property is currently occupied then all parties should work together to agree a delay or another way to resolve this matter.

- If moving is unavoidable for contractual reasons and the parties are unable to reach an agreement to delay, people must follow advice on staying away from others to minimise the spread of the virus.

- In line with Government’s advice, anyone with symptoms, self-isolating or shielding from the virus, should follow medical advice which will mean not moving house for the time being, if at all possible. All parties should prioritise agreeing amicable arrangements to change move dates for individuals in this group, or where someone in a chain is in this group.

What if an extension goes beyond the terms of a mortgage agreement?

UK Finance have today confirmed that, to support customers who have already exchanged contracts for house purchases and set dates for completion, all mortgage lenders are working to find ways to enable customers who have exchanged contracts to extend their mortgage offer for up to three months to enable them to move at a later date.

If a customer’s circumstances change during this three month period or the terms of the house purchase change significantly and continuing with the mortgage would cause house buyers to face financial hardship, lenders will work with customers to help them manage their finances as a matter of urgency.

If your home is not yet on the market

Getting your home onto the market may be more challenging than usual in this period.There should be no visitors to your home. You can speak to Estate Agents over the phone and they will be able to give you general advice about the local property market and handle certain matters remotely but they will not be able to start actively marketing your home in the usual manner.

- If you are thinking about selling, you can use this time to start gathering together all of the information you will need to provide to potential purchasers.

- Advice for people to stay at home and away from others means you should not invite unnecessary visitors into your home, including: Property Agents to carry out a market appraisal or take internal photographs prior to marketing your home; and Energy Performance Certificate assessors.

Viewings

If your property is already on the market, you can continue to advertise it as being for sale but you should not allow people in to view your property.

- There should not be any visitors into your home, and you should therefore not let people visit your property for viewings. Your agent may be able to conduct virtual viewings and you could speak to them about this possibility.

Accepting offers

The buying and selling process can continue during this period but you should be aware that the process is likely to take longer than normal.

- You are free to continue to accept offers on your property, however the selling process may take longer.

- Advice for people to stay at home and away from others means you should not invite visitors into your home, including prospective buyers or advisors.

Exchanging contracts

Once you have exchanged contracts, you have entered into a legal agreement to purchase that home.

- If the property you are purchasing in unoccupied you can continue with the transaction.

- If the property you are purchasing is currently occupied, we recommend that all parties should work either delay the exchange of contracts until after the period where stay-at-home measures to fight coronavirus (COVID-19) are in place, or include explicit contractual provisions to take account of the risks presented by the virus.

Advice to industry

All businesses must follow the Government’s latest Guidance for employers and businesses on coronavirus (COVID-19).

Estate Agents

Estate Agents should ensure they are able to support clients during this period:

- Agents should work with their clients and other agents to broker a new date to move where sales are due to complete on occupied properties in the current period where emergency measures are in place to fight coronavirus (COVID-19).

- Agents should prioritise support for anyone with symptoms, self-isolating or shielding from the virus, and those they are in chain with, to agree a new date.

- In line with advice for certain businesses to close, agents should not open branches to the public during this period, or visit people’s homes to carry out market appraisals.

- Agents should ensure that employees can work from home, to support existing clients and advise potential new clients.

- Agents should continue to progress sales where this can be done whilst following guidance to stay at home and away from others.

- Agents should advise clients to be patient and not to exchange contracts unless the contracts have explicit terms to manage the timing risks presented by the virus.

Conveyancers

Conveyancers should continue to support the sales process as far as possible and should make sure their clients are aware of the difficulties of completing transactions in this period:

- Conveyancers should continue to support the sales of unoccupied properties as far as possible.

- Conveyancers should make every effort to support clients who are due to complete on occupied properties in the stay-at-home period to change this date.

- Conveyancers should advise their clients who are ready to move not to exchange contracts on an occupied property unless they have made explicit provision for the risks presented by the virus.

- Conveyancers should prioritise support anyone with symptoms, self-isolating or shielding from the virus and those they are in chain with, and we urge them to do all they can to help a new date to be agreed in these circumstances.

Surveyors

Surveyors should not expect to carry out non-urgent surveys in homes where people are in residence, and no inspections should take place if any person in the property is showing symptoms, self-isolating or being shielded. It may be possible to carry out some of your work online and also carry out urgent surveys on empty properties, or those where the occupants are out of the property or following guidance to stay at home and away from others.

- Surveyors should follow the latest Government guidance which currently (26 March 2020) states that work carried out in people’s homes can continue, provided the tradesperson is well and has no symptoms of coronavirus (COVID-19).

- It is important to ensure Government guidelines are followed, including maintaining a 2 metre distance from others, and washing their hands with soap and water often for at least 20 seconds (or using hand sanitiser gel if soap and water is not available).

- No work should be carried out by a person who has coronavirus (COVID-19) symptoms, however mild.

Removals Firms

There will be people who have already committed to moving home; where possible we are encouraging them to delay their move but a small number of moves may need to go ahead. We would urge everyone to take all sensible precautions to ensure the move can happen safely.

- Removers should honour their existing commitments where it is clear that the move can be done safely for the client and your own staff and it is clear that the moving date cannot be moved.

- Removers should follow the latest Government guidance which currently (26 March 2020) states that work carried out in people’s homes can continue, provided the tradesperson is well and has no symptoms or coronavirus (COVID-19).

- It is important to ensure Government guidelines are followed, including maintaining a 2 metre distance from others, and washing their hands with soap and water often for at least 20 seconds (or using hand sanitiser gel if soap and water is not available).

- No work should be carried out by a person who has coronavirus (COVID-19) symptoms, however mild.

A video has been launched this morning explaining how agents can get their sellers and landlords to use iPhones to make videos appropriate for marketing.

The ‘How To Do It’ video is 12 minutes long and produced by industry consultant Chris Watkin, and it’s shared below with Estate Agent Today readers.

Chris says: “Have a look at the video and then send it to all your landlords and vendors. Make yourself look pro-active as an agent.

“Please tag every agent you know to ensure they can help their clients too. This isn’t the time for rivalry with competitors – let’s help each other.”

Later this week Chris will be revealing a video series for agents to learn how to edit videos like a pro using inexpensive software and a small amount of hardware.

This may be exactly what the industry needs for the next few months.

Propertymark has been told the agents should shut their offices immediately – they are not “essential businesses” under the new Coronavirus safety guidance.

A statement from Propertymark issued this afternoon says:

“Propertymark has spoken to a senior civil servant at Ministry for Housing, Communities and Local Goverment (MHCLG) this morning.

“The civil servant stated that agents are not ‘essential businesses’ under the new rules and therefore their view is that agents should close their offices immediately.

“Furthermore, they stated that there should not be any in-person viewings, routine inspections or house moves.

“MHCLG is still looking into property maintenance tasks such as gas safety checks and hopes to issue guidance on these points as soon as possible.

“In a further development, British Association of Removers (BAR) has issued communications this morning instructing members that moves should only be completed if they are already underway, any move that has not yet started, should not go ahead.

“Propertymark will keep members up to date later today and as any further information becomes available.”